Posted November 04, 2025

By Ian Culley

Give Gold a Rest (and Trade This Miner Instead)

Can we all give gold a rest? Silver, too. They deserve it.

They’ve ripped, they’ve roared, and they’ve hit new highs — all while surpassing records and shattering most investors’ imaginations.

Heck, we all deserve a break from these shiny rocks. But that doesn’t mean it’s time to kick other commodities to the curb.

The simple fact that gold rallied in the first place tells us what’s next for the broader commodity space.

Today, I’ll explain what the historic precious metal rally suggests for risk assets and highlight a group of stocks already benefiting.

I’ll also reveal one ticker you can use to catch the next rip-roaring rally.

Gold Leads

Over 40 years ago, the technical intermarket analysis pioneer John J. Murphy made a poignant observation: Gold acts as a leading indicator for the broader commodity space.

He noted that gold led the Commodity Research Bureau Index (CRB) at significant peaks and troughs during the 1980s. Gold bottomed in ‘85, roughly one year before the CRB, and peaked in December ‘87 ahead of the commodity index’s summer ‘88 top.

Perhaps it all comes down to the gold market’s sensitivity to inflation. You could argue that the current gold rally started in June 2019 just as core PCE readings began to creep higher. (Gold bugs do have a nose for inflation.)

Either way, gold continues to serve as a leading indicator. Check out the shiny yellow rock overlaid with copper.

I chose copper as a proxy based on its sensitivity to the global economy and its strong positive correlation to commodities as a whole.

However, I could’ve just as easily used silver. Both charts clearly highlight gold’s status as a leading indicator.

I outlined the three most recent breakouts for each metal in green.

Notice gold cleared its early 2000 high in September ‘02, slightly more than a year before copper would climb above its respective level.

Again, gold led copper by roughly 17 months in ‘19 and by almost 15 months in ‘24.

In fact, gold’s 2024 breakout heavily weighed on my bullish outlook on platinum, palladium, and South African mining company Sibanye Stillwater (SBSW) this year. Those trades have produced absolute gangbuster returns.

Based on past cycles and John J. Murphy's observations, we should expect continued rallies in metals and, eventually, in other commodities, too.

Commodities like lithium.

Lithium Follows

The Global X Lithium & Battery Tech ETF (LIT) offers a solid read despite being anything but a pure lithium play.

For starters, you’ll find Rio Tinto Plc (RIO) dominates LIT (almost 20%). Unfortunately, RIO primarily mines copper, iron ore, and aluminum minerals. Then you have Sociedad Quimica y Minera de Chile SA (SQM), which has a hand in lithium and its derivatives, but also produces fertilizer and specialty chemicals. (Keep an eye on SQM!)

You’ll even notice a little Tesla Inc. (TSLA) in there, accounting for approximately 4% of the ETF.

I see LIT’s diverse holdings as a bonus. You still have a quality commodity play, plus a dash of tech growth. (What’s not to like?)

Most importantly, it also trailed the gold rallies that began in 2016 and 2019 with its own explosive moves of 175% and 435%, respectively.

So far, LIT has run roughly 101% since gold’s 2024 breakout and will likely continue to run to new highs over the coming quarters.

But if I had to choose one lithium stock…

This Ticker Will Rip

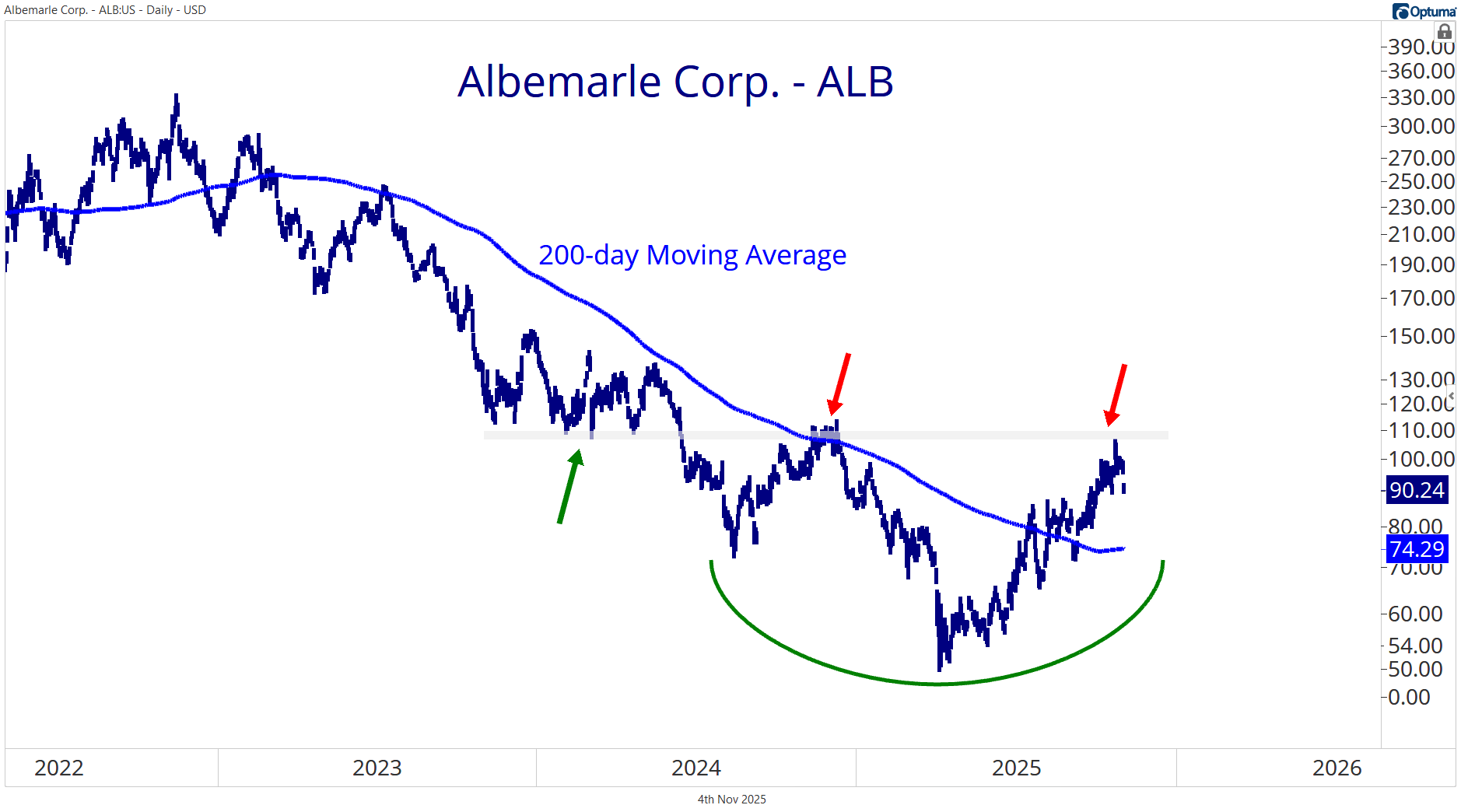

Albemarle Corp. (ALB) has my full attention.

ALB manufactures lithium chloride, lithium hydroxide, and lithium carbonate, as well as other specialty lithium solutions. It’s a lithium powerhouse and specialty chemicals company. And it’s based in the U.S. (Charlotte, NC).

Best of all, the ALB chart offers you an excellent way to define your risk. Plus, its long-term moving average is turning higher (always a good look).

Last week, ALB ran into a shelf of former lows that acted as a floor from November 2023 until the summer of 2024. Now those former lows are acting as a ceiling.

That’s your level. Risks are to the upside for ALB if and when it clears last year’s peak.

On the other hand, the path of least resistance points sideways to lower until ALB reclaims those former lows.

I think it’s simply a matter of time before ALB rips and roars to new highs. Gold paved the way. Other commodities have followed.

And perhaps most importantly, the precious metal trade deserves a rest.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Hyper-Caffeinated Sticker Shock

Posted November 16, 2025

By Ian Culley

An UP-date on the Melt-DOWN

Posted November 14, 2025

By Greg Guenthner

7 Final Lessons From Buffett’s Farewell

Posted November 13, 2025

By Enrique Abeyta

Warren Buffett, Signing Off One Last Time

Posted November 10, 2025

By Enrique Abeyta

3 Beaten-Down Charts Ready to Bounce

Posted November 07, 2025

By Greg Guenthner