Posted February 27, 2025

By Enrique Abeyta

EARNINGS UPDATE: Why NVDA Just Won’t Budge

The most important earnings report of 2025 dropped last night. And the result was…

Not a whole lot.

Of course, I’m talking about the AI semiconductor giant Nvidia (NVDA).

In the last few years, NVDA has dominated the stock market conversation in a way that few stocks have in my three-decade career.

Investors were feeling antsy going into the report.

Earlier this year, the stock market lost $2 trillion on concerns about the Chinese AI company DeepSeek.

On that day, NVDA posted a one-day market cap loss of almost $600 billion. This was the largest one-day loss in the history of the stock market by far.

In the days leading up to NVDA’s earnings, we saw AI-related stocks sell off dramatically again.

So, what did we learn from last night’s report?

Breaking Down the Numbers

An objective observer would say that Nvidia’s actual earnings numbers were great.

The company grew revenues 78% year-over-year, grew EPS 80% year-over-year, and posted outstanding margins.

They also raised their guidance for the upcoming quarter and beat results and guidance on almost every single metric.

The one exception is next quarter’s gross margin, but it was a very small adjustment and likely conservative.

Growing results 80% year-over-year at the massive scale of NVDA (almost $40 billion of quarterly sales) is one of the most impressive operational results ever seen.

Again, these results were great. So why didn't the stock respond better to a great earnings report?

I write a lot about the concept of investor “positioning” to understand why stocks trade how they do.

In the short term, it isn’t as important what a company reports but rather what the expectations are going into the report.

With high-flying stocks, it can even become the expectations about the expectations.

Throughout 2024, NVDA posted outstanding results and beat expectations to an extent seldom seen in stock market history.

Here is a table of their quarterly EPS results over the last few years.

We have circled the last few years, and you can see that they began posting blow-out numbers beginning seven quarters ago.

They then proceeded to post four full quarters of growth over 400%. This attracted a LOT of attention from investors.

For a company the size of NVDA to post those kinds of results is something we have never seen in the market.

Going Above and Beyond

Not only were they growing, though, but they were also blowing away expectations.

Here is a table showing their reported results compared to analysts’ forecasts:

You can see that the company absolutely crushed results starting in 2023. Since then, the magnitude of those beats has come down steadily.

The overall results are still incredibly impressive. But the analysts’ expectations have begun to catch up with their operations.

This track record of growth and beating numbers was unprecedented and drove a massive move higher in the stock.

Here is the chart of the stock price over the last few years.

You can see the move from below $20 per share at the start of 2023 to a recent high in January of this year.

The move in 2023 is particularly impressive with the going from $40 to a level near $150 per share — up almost fourfold in just one year.

We have highlighted that upward move on the chart with a green line.

We have also added another line showing what the stock has done since last June: NOTHING. It has been flat for the last eight months.

Despite these incredible results, if you have owned this stock for most of the last year, you haven’t made ANY money.

Why NVDA Has Gone Nowhere

This is a result of the positioning in the stock.

The incredible move in both results and the stock price brought on millions of new investors in the shares.

They became excited by the growth and the fact that the company handily beat expectations.

The incredible growth has continued, but the massive outperformance versus expectations has come down a lot.

The lower beats are no longer attracting new investors to the stock in the same way. In fact, some may actually be selling.

Regardless, the stock is not declining because new investors look at the growth and value and find the shares attractive.

In technical analysis, these types of periods are called “consolidation” or “distribution.”

Think of it as one group of shareholders swapping out for another group of shareholders. In this case, momentum investors are unloading their shares for growth and value investors.

The Slow Road Ahead

What does this mean for the future of the stock?

Ultimately, it comes down to those earnings.

If the company can continue to meet and beat numbers, then I think the stock will be just fine. At some point, the stock price will start grinding higher again to reflect the accrued earnings.

It is unlikely to go up as much as before because the company is neither beating numbers by as much nor growing as much.

In the near term, I think the stock is unlikely to do very much as it digests this shareholder transition.

On the back of the last quarterly report, the stock posted an upward move of just 0.5% on the day, and it looks to do something similar today.

Good results, though, will mean that NVDA will be just fine. I think that is likely to happen over the next few quarters.

The momentum right now is that strong. Also, the recent capital expenditure guidance from the big technology companies supports a positive outlook for the next few quarters.

My concern, however, is that the investments by these companies will also decelerate at some point.

They will stop growing the amount they are investing in AI data centers or even reduce that spending.

They don’t even have to reduce the amount in AI overall, but rather move it from equipment to software, and you will see a reduction in spending on NVDA chips.

Add in the eventuality of competitors with products that are attractive on both price and capability, and I think the results at NVDA will continue to slow down.

But I think NVDA’s results are good enough for now. So in the meantime, we remain in the calm before the storm.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

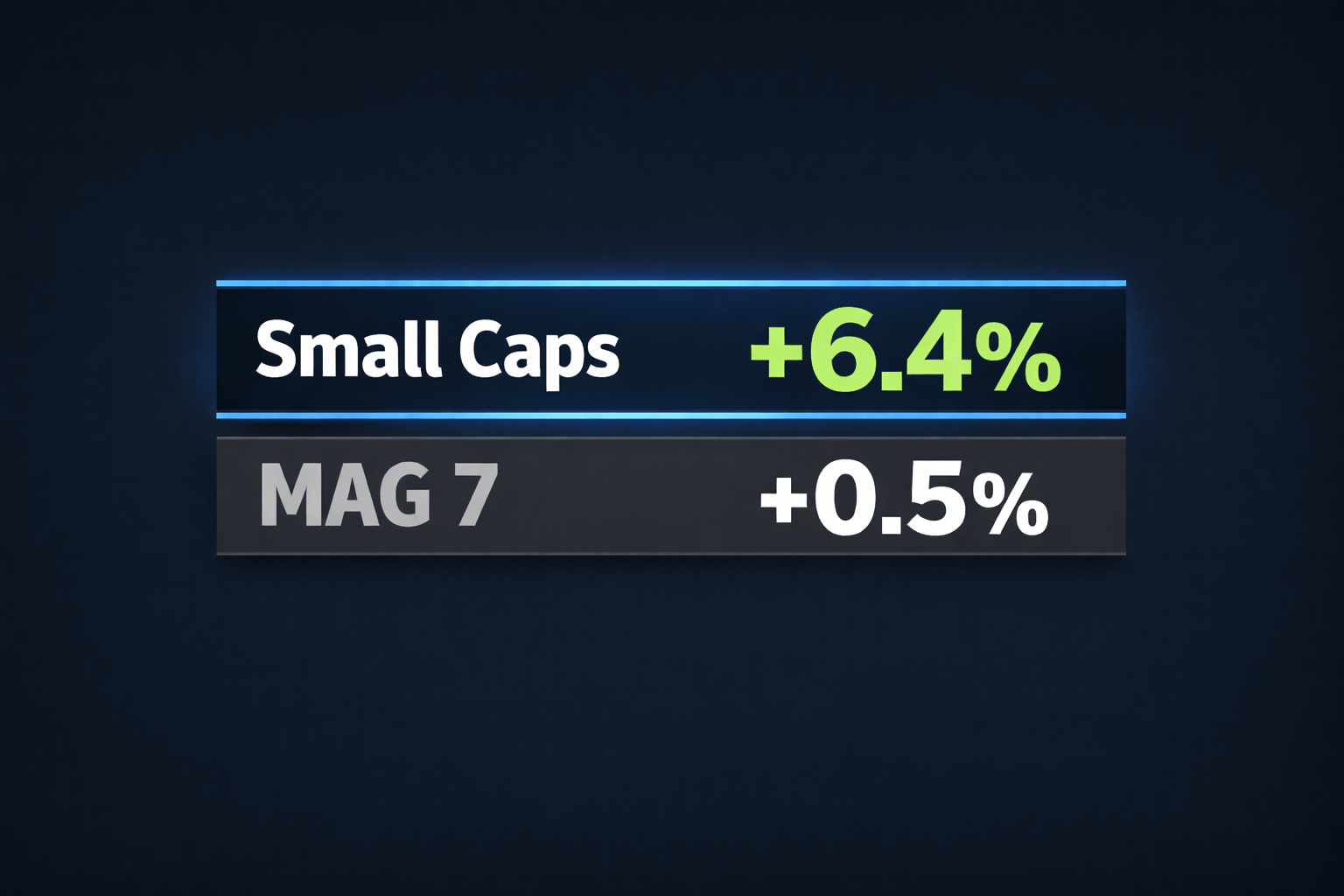

Small Caps Are Back, Baby!

Posted January 23, 2026

By Greg Guenthner

Greenland, Carry Trades, and Lazy CNBC Takes

Posted January 22, 2026

By Enrique Abeyta

“TACO” Out… “Big MAC” In

Posted January 19, 2026

By Enrique Abeyta

What to Do While Silver Goes Vertical

Posted January 16, 2026

By Greg Guenthner

Insider Trading From Hamilton to Pelosi

Posted January 15, 2026

By Enrique Abeyta