Posted January 12, 2026

By Enrique Abeyta

“BTSD” — The Powell Probe Trade

Not all breaking news matters.

The latest story about Jerome Powell is a perfect example. By now, you’ve seen the headlines.

Source: New York Times

The media framed the story as explosive, and the market’s reaction suggested something catastrophic had occurred.

But the reality is that nothing meaningful changed at all.

Last night’s announcement wasn’t a conviction or even an official charge of wrongdoing. It was simply the opening of an investigation.

That distinction is huge, but it got lost almost immediately. The narrative had been framed as a worst-case scenario.

Stocks traded lower and risk assets wobbled as commentators speculated whether this is the beginning of some grand unraveling.

The implication was that the Federal Reserve is suddenly compromised and markets should reprice accordingly.

That’s absolutely preposterous. And believing it could lose you money.

The Selloff Made No Sense

Investigations are not verdicts or proof. In this case, there’s been no formal charge and no finding of guilt.

There’s certainly no sign that monetary policy, economic data, or corporate earnings are materially impacted in any way.

Yet the market reacted as if the most extreme interpretation were already fact.

If you zoom out and look at what actually matters right now, the disconnect becomes obvious.

- Market strength has been broadening, not narrowing.

- Leadership is no longer confined to a handful of mega-cap names.

- Interest rates have been drifting lower, easing financial conditions rather than tightening them.

- Oil prices are down, which acts as a tax cut for consumers and businesses alike.

- And corporate earnings growth remains solid, with margins holding up better than most feared just a few quarters ago.

These are real inputs that drive markets over time.

Against that backdrop, a knee-jerk selloff tied to the announcement of an investigation without charges or conclusions isn’t just overblown — it’s absurd.

The market has a long history of confusing noise for signal, especially when the news involves powerful institutions or recognizable names.

Traders see a scary headline, algorithms react to keywords, and prices move before anyone stops to ask whether anything changes about cash flows, growth, or valuation.

Often, it doesn’t.

Smart Money Isn’t Panicking

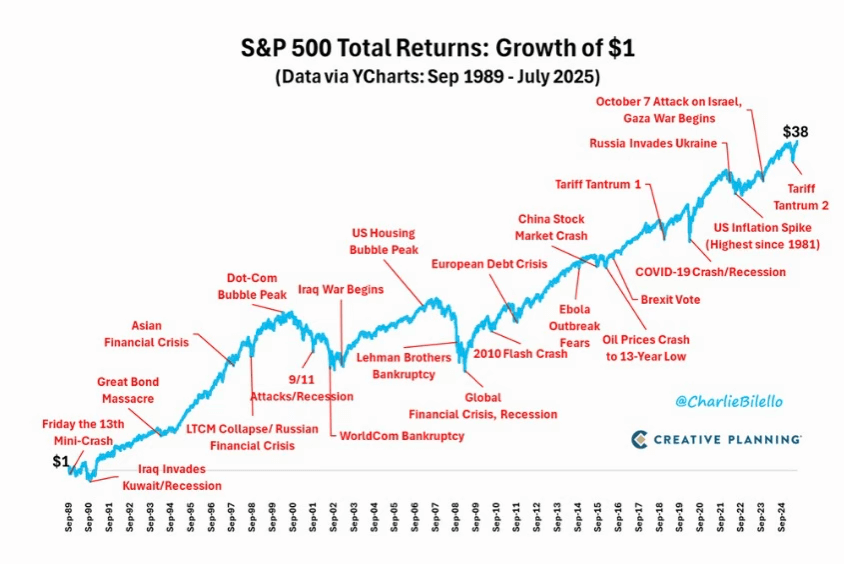

To prove my point, here’s a great chart from one of my favorite financial voices, Charlie Bilello from Creative Planning.

Source: Creative Planning

It highlights the market's reaction (or lack thereof) to major historical events.

Looking at the chart, you can see that even significant events like the 2016 Brexit vote barely registered on S&P total returns.

Now, I'm not saying that the Powell investigation isn't important.

But if the UK leaving the EU after more than four decades barely impacted the S&P 500's trajectory, do you really think this Powell headline will have a lasting impact?

For all we know, it may not even matter by tomorrow.

One of the most telling data points from today isn’t coming from Wall Street at all. It’s from the betting markets.

Source: Polymarket

A popular Polymarket showed the odds of Jerome Powell being federally charged by June 30 at just 12%.

A far cry from inevitability. That's a market assigning a low probability to a scenario that headlines treat as a near certainty.

In other words, smarter money already knows this is being overplayed.

This disconnect between headlines and reality is not new, and it’s not unique to this situation.

It happens during debt ceiling standoffs, government shutdown threats, surprise resignations, geopolitical flare-ups, and policy rumors.

Over and over again, the market sells first and asks questions later. When cooler heads prevail, prices quietly recover.

That brings me to a new acronym...

BTSD: Buy the Stupidity Dip

This isn’t about ignoring risk or pretending that bad news doesn't exist.

It's about recognizing when the market reacts emotionally to information that doesn't materially alter the underlying investment landscape.

In other words, it’s about separating narrative from numbers, headlines from hard data, and speculation from substance.

The Powell story checks every box of a classic “BTSD” setup.

The news is incomplete, the implications are exaggerated, and the broader market backdrop remains constructive.

When you put all of that together, selling stocks aggressively in response to this headline makes no sense.

In fact, I wasn’t surprised at all to see the stock market claw its way back throughout the day and end in the green.

Once traders step back and realize that nothing concrete has actually happened, the urgency to sell tends to fade.

This is how opportunity is created.

The market doesn’t hand out easy money. It extracts it from those who react without thinking and redistributes it to those who remain disciplined when others panic.

“BTSD” moments are uncomfortable because they feel wrong.

It feels counterintuitive to buy when headlines are screaming at you to sell. But historically, those are often the moments that deliver the best risk-adjusted returns.

None of this means volatility disappears or that you should blindly buy every dip. Context always matters.

But in situations like this, where the reaction is clearly disconnected from fundamentals, the playbook is straightforward.

Slow down. Filter out the noise. And focus on what actually drives markets.

Since the market seems to enjoy repeating this pattern over and over again, you may as well embrace it.

“BTSD” isn’t just a slogan; it’s a mindset. And on occasions like this, it’s how investors make real money.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Revealed: The New Momentum Trades for 2026

Posted January 09, 2026

By Greg Guenthner

5 Healthy Investing Habits to Start Today

Posted January 08, 2026

By Enrique Abeyta

2026: The Leaders, the Laggards, and a Wild Card

Posted January 05, 2026

By Enrique Abeyta

Optimism Wins: A Fresh Mindset for 2026

Posted January 01, 2026

By Enrique Abeyta

War, Media Game of Thrones, and a Shocking Assassination

Posted December 29, 2025

By Enrique Abeyta