Posted December 02, 2025

By Ian Culley

Breakout Alert: Copper Coils for a Monster Move

Stocks that delivered the bulk of returns last quarter are now causing more headaches than anything else. And don’t even get me started on crypto… What a hot mess!

You can’t deny the market melt-up doubts growing in the pit of your stomach.

Yet despite persistent challenges for the broad U.S. stock market, not all stocks are stuck in a rut.

Some names are actually rising and offering investors a chance to capture a bit of that long-awaited seasonal strength.

Today, I’ll show you one group of stocks outperforming the broad market – along with my top ticker of the bunch.

Let’s dive in…

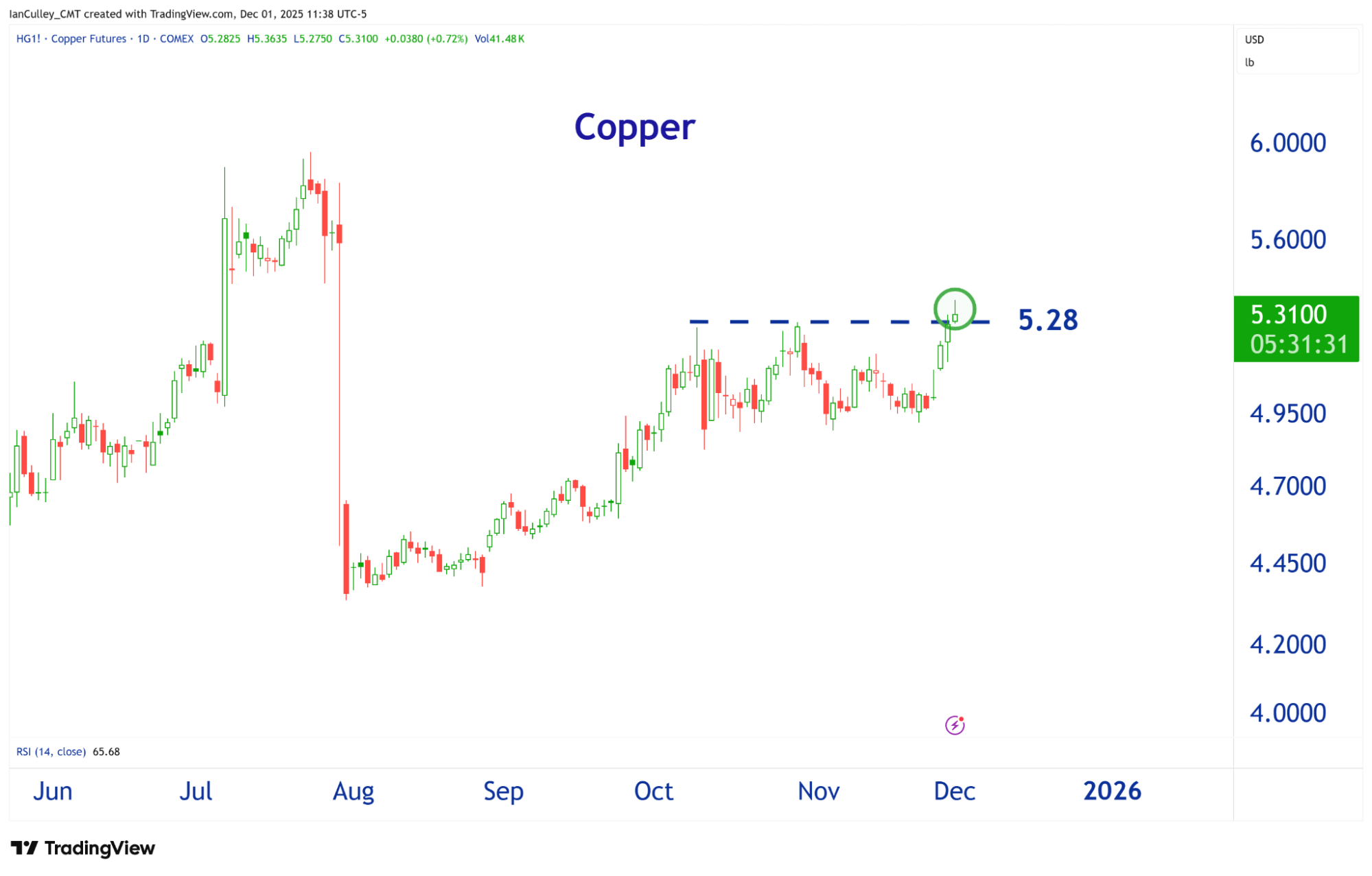

Dr. Copper’s Breakout

While quantum computing stocks and other hot tech themes registered new lows last month, copper quietly carved out a tradable low.

I know, I know, copper isn’t a stock. You’re 100% correct. And if you’re sick of hearing about metals, I get it.

I mentioned stocks and will get to them in just a minute. (Spoiler alert: they’re companies that mine copper and other natural resources.)

For now, stick with me…

Yesterday, copper broke out to fresh multi-month highs. These new highs not only triggered a buy signal but also confirmed what gold has been telling us for the past five years: commodity supercycle.

However, Dr. Copper is notorious for throwing headfakes and whipsaws at unsuspecting traders, so you have to stay on your toes if you decide to trade the following names.

You want to see copper trading above $5.28. The path of least resistance points decisively higher for the industrial metal and the following group of stocks — if and only if copper is trading above its October high.

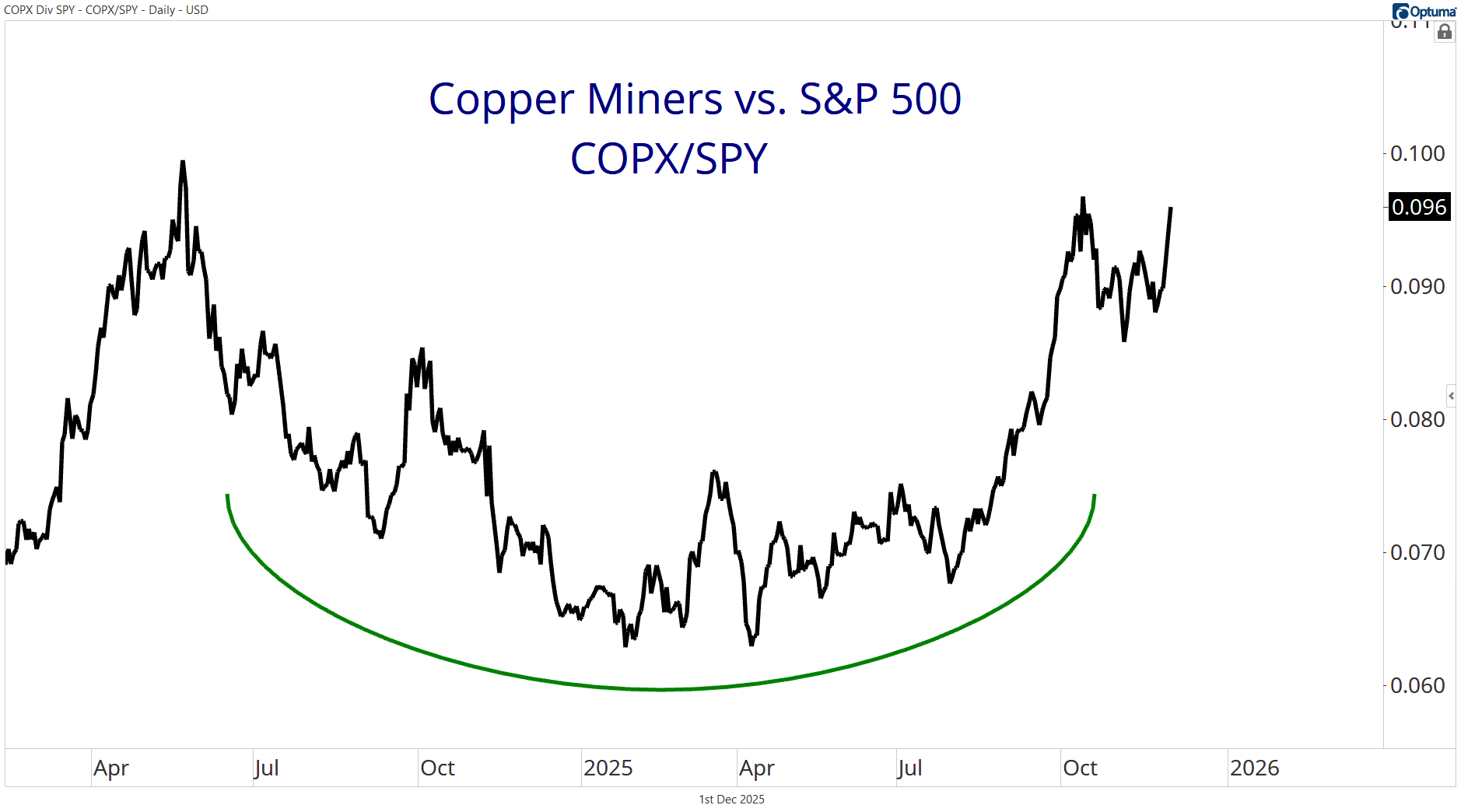

Undeniable Relative Strength

Copper mining names have beaten the market over the past eight months, and from the looks of it, just embarked on another bout of relative strength.

U.S. stocks have undoubtedly recovered from Trump’s tariff extravaganza in the Rose Garden. Since April 7, the S&P 500 is up 35%, the Nasdaq 100 is up 47%, and the small-cap Russell 2000 is up 36%.

It’s difficult to be bearish on U.S. stocks when staring down those numbers.

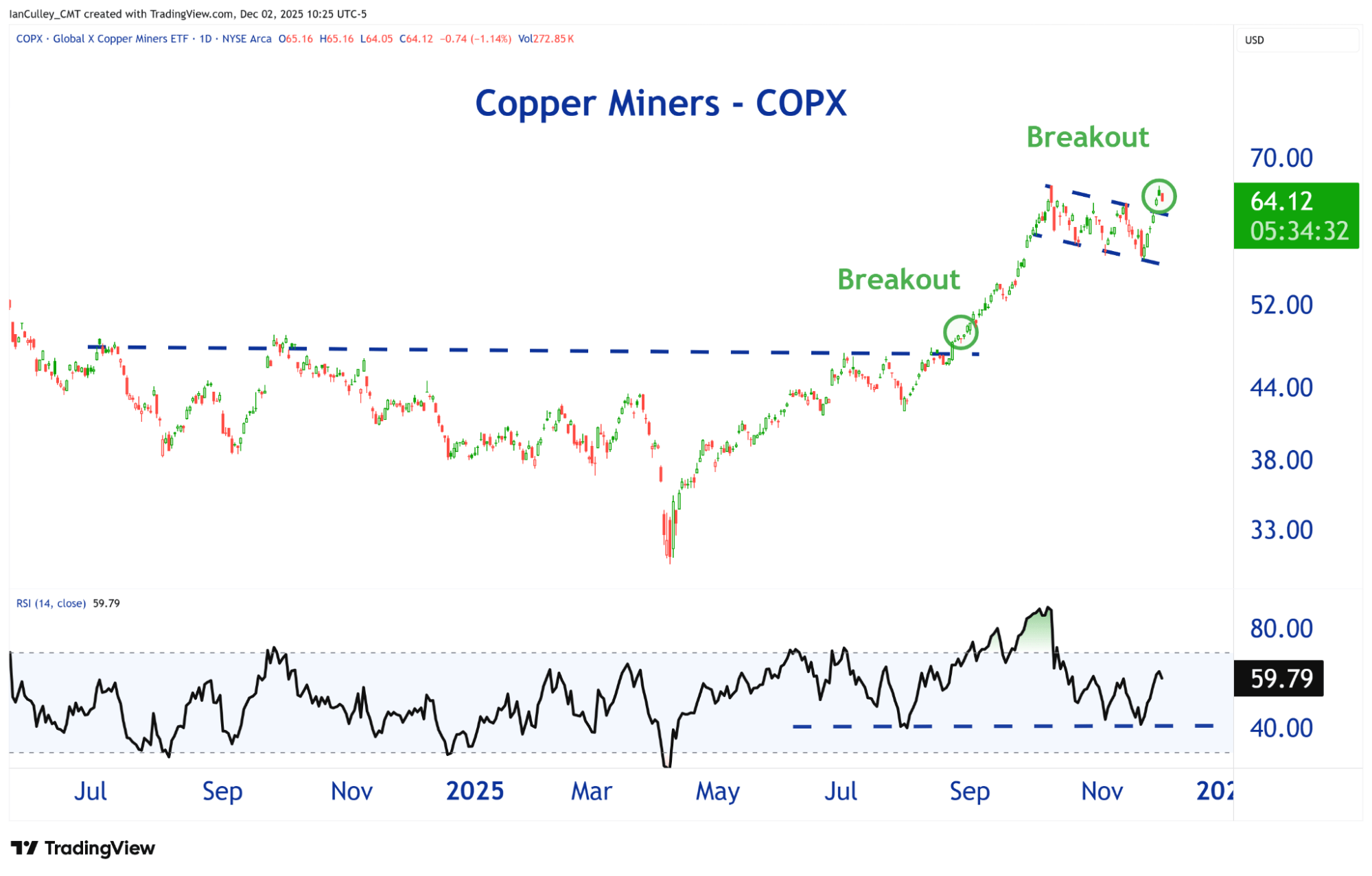

That said, copper mining stocks have risen at a faster clip than the broader market since the April low. In fact, the Global X Copper Mining ETF (COPX) is up a cool 96% since the S&P 500 hit bottom.

Check out COPX relative to the S&P 500.

This is a ratio chart that measures the relative performance between two assets. The numerator (COPX) is outperforming when the line is rising. On the flip side, the denominator (SPY) is outperforming as the line falls.

To be clear, both assets can rally regardless of the direction of the COPX/SPY ratio — a simple fact that often gets overlooked.

The ratio’s trend simply reveals strength. That’s why we use ratio charts for relative strength studies.

Notice the copper miners bottomed relative to the U.S. equity benchmark in early April, and have steadily posted a series of higher highs and higher lows (the definition of an uptrend) on a relative basis.

That’s what relative strength looks like.

The Play

You have plenty of options when it comes to copper mining stocks.

Some of my favorites include:

- The industry bellwether Freeport-McMoRan Inc. (FCX)

- The largest publicly traded copper mining company Southern Copper Corp. (SCCO)

- And the small-cap Hudbay Minerals Inc. (HBM).

I also like the Canadian miner, Teck Resources Ltd. (TECK). It has broad exposure to natural resources and has been in operation since 1951, so it’s survived a few commodity boom-and-bust cycles.

All are excellent options when taking a bullish stance on copper. But, of course, they all carry company-specific risk.

Underground fires… toxic gases… flooding….

Disaster can strike mines, sending share prices rolling at the slightest setback in production.

On the bright side, you can diversify away company-specific risk with the Global X Copper Miners ETF.

COPX holds all of the companies mentioned above, plus many more. The ETF helps you sidestep the risks associated with buying individual names, which is why it’s my top pick heading into year-end.

Best of all, it’s breaking out of a multi-month bullish consolidation — the type of price pattern that forms during strong uptrends.

Also, momentum never reached oversold levels during the broad market correction. An RSI reading below 30 constitutes an oversold reading.

COPX’s 14-day RSI held above 40 (highlighted in the lower pane), another sign of relative strength.

The COPX chart alone demands your consideration. Throw in the simple facts that it has bested all the major averages and shows no signs of slowing down…

What’s not like?

Yes, the past couple of months have left many traders sick to their stomachs. It’s choppy out there.

But you can still profit into year-end by leaning into the tickers that have shown relative strength for most of 2025.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

![[VIDEO] The Year-End Rally Is Back On!](http://images.ctfassets.net/vha3zb1lo47k/4mfoBVvX4hSw8BLbDAjPP7/c13db091bfeef2a493bcfd0f1e73df14/ttr-issue-12-05-25-img-post.jpg)

[VIDEO] The Year-End Rally Is Back On!

Posted December 05, 2025

By Greg Guenthner

Time for a Reality Check

Posted December 01, 2025

By Enrique Abeyta

Thankful for the Greatest Game on Earth

Posted November 27, 2025

By Enrique Abeyta

The Art of the Stop Loss

Posted November 25, 2025

By Ian Culley

A “Blue Owl” in the Coal Mine

Posted November 24, 2025

By Enrique Abeyta

![[VIDEO] How to Spot a Bounce Worth Buying](http://images.ctfassets.net/vha3zb1lo47k/52knC5jBCw9jj5rBVAQMRs/9213f9d92a2262a0ec1b42df9a62678d/ttr-issue-11-21-25-img-post-2.jpg)