Posted January 17, 2025

By Greg Guenthner

Bitcoin Defies the Drawdown

Renewed inflation fears gave speculators the perfect excuse to sell their stocks over the past six weeks.

Of course, everyone’s probably getting way too bearish right now. Santa failed to show, January is off to a back-and-forth start, and sellers have knocked a lot of air out of the frothiest stocks that were screaming higher during the fourth quarter.

As stocks began to recover following favorable inflation data earlier this week, I’m sure there’s one question on your mind: What should I look to buy in this choppy market?

Many of the popular stocks that folks were trading back in November might need more time to set up for fresh trades. But there is one asset that’s ripe for another strong rally…

I’m talking about Bitcoin.

Here are three reasons why Bitcoin is set to rise and quickly break above its December highs.

1. Crypto Stocks Are Already Catching Fire

While Bitcoin is still flirting with $100K, we’re seeing some of the beaten-down crypto miners stretch their legs.

Hut 8 (HUT) logged double-digit gains on Wednesday as Bitcoin extended higher. Meanwhile, Riot Platforms (RIOT) jumped nearly 10% to post fresh January highs. CleanSpark (CLSK) also gained more than 8% to post its fourth straight day of gains.

Granted, these Bitcoin miner charts are far from perfect (I’d say HUT is my favorite one at the moment). But we can’t discount the fact that these stocks are already posting big moves — as if they’re anticipating an impending Bitcoin breakout following nearly two months of sideways action.

Aside from the miners, we’re also seeing strong moves from other crypto-adjacent stocks. Trading app Robinhood Markets (HOOD) is even breaking out to fresh all-time highs this week as it enjoys the one-two punch of positive analyst comments and a finalized SEC settlement.

If speculators are going after the crypto plays in the stock market, it’s only a matter of time before Bitcoin falls in line and continues its march higher.

2. Is It 2021 All Over Again?

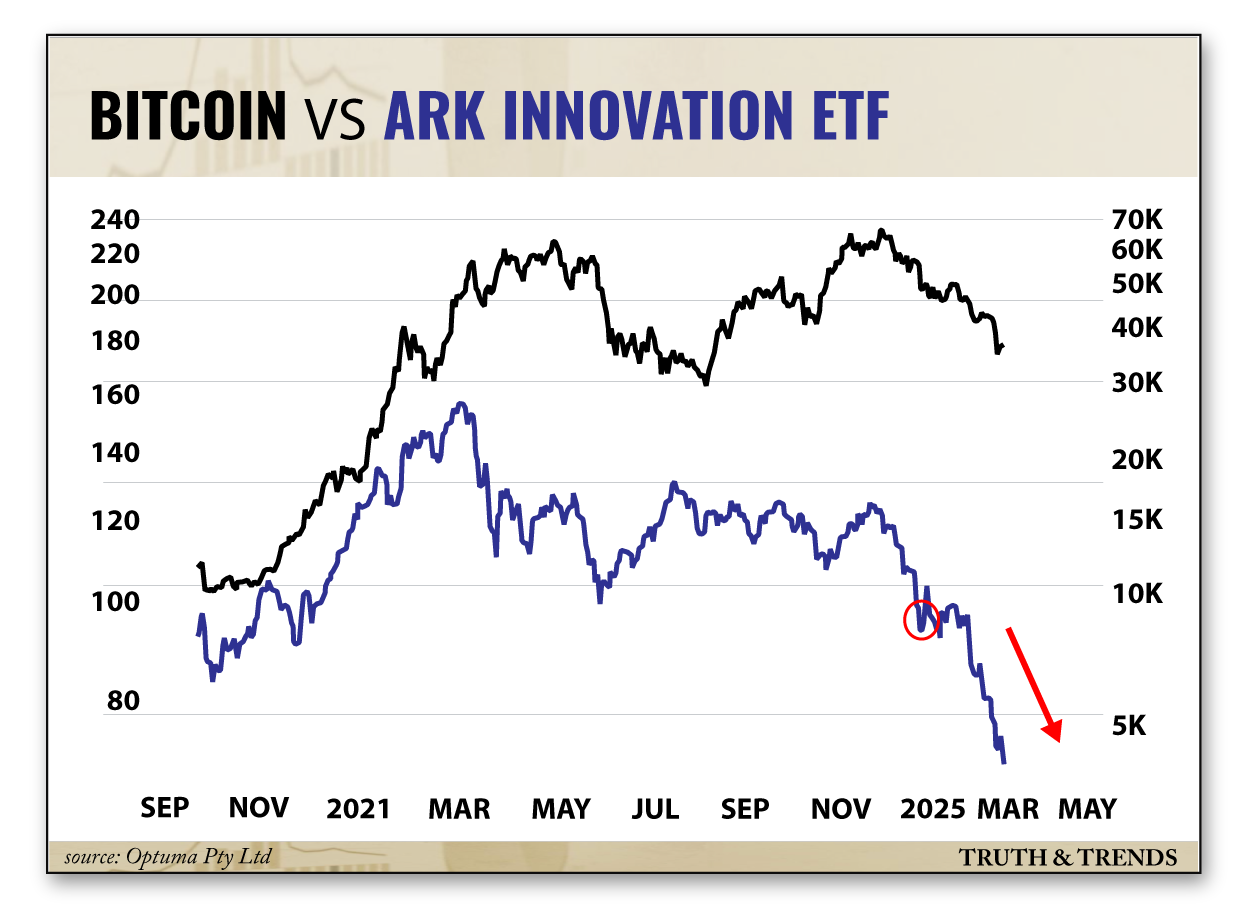

Bitcoin enjoyed a huge rally during the pandemic trading boom in Q4 2020. Crypto continued its hot streak into January 2021, just as huge squeezes in Tesla (TSLA) and meme stocks like GameStop (GME) dazzled traders.

January 2025 hasn’t been as kind to speculative stocks thus far. But remember, Bitcoin didn’t need any extra juice from the stock market to continue its romp in 2021. While most of the frothy names ran out of steam by early February, Bitcoin continued to push higher into mid-April.

But that wasn’t the top. Bitcoin traded within a $30K range for the remainder of the year, while speculative growth areas of the market such as the ARK Innovation ETF (ARKK) were cut in half.

Will we see the 2021 scenario unfold again?

I don’t have a crystal ball, so I can’t say for certain. But I wouldn't be surprised if the next few months rhyme.

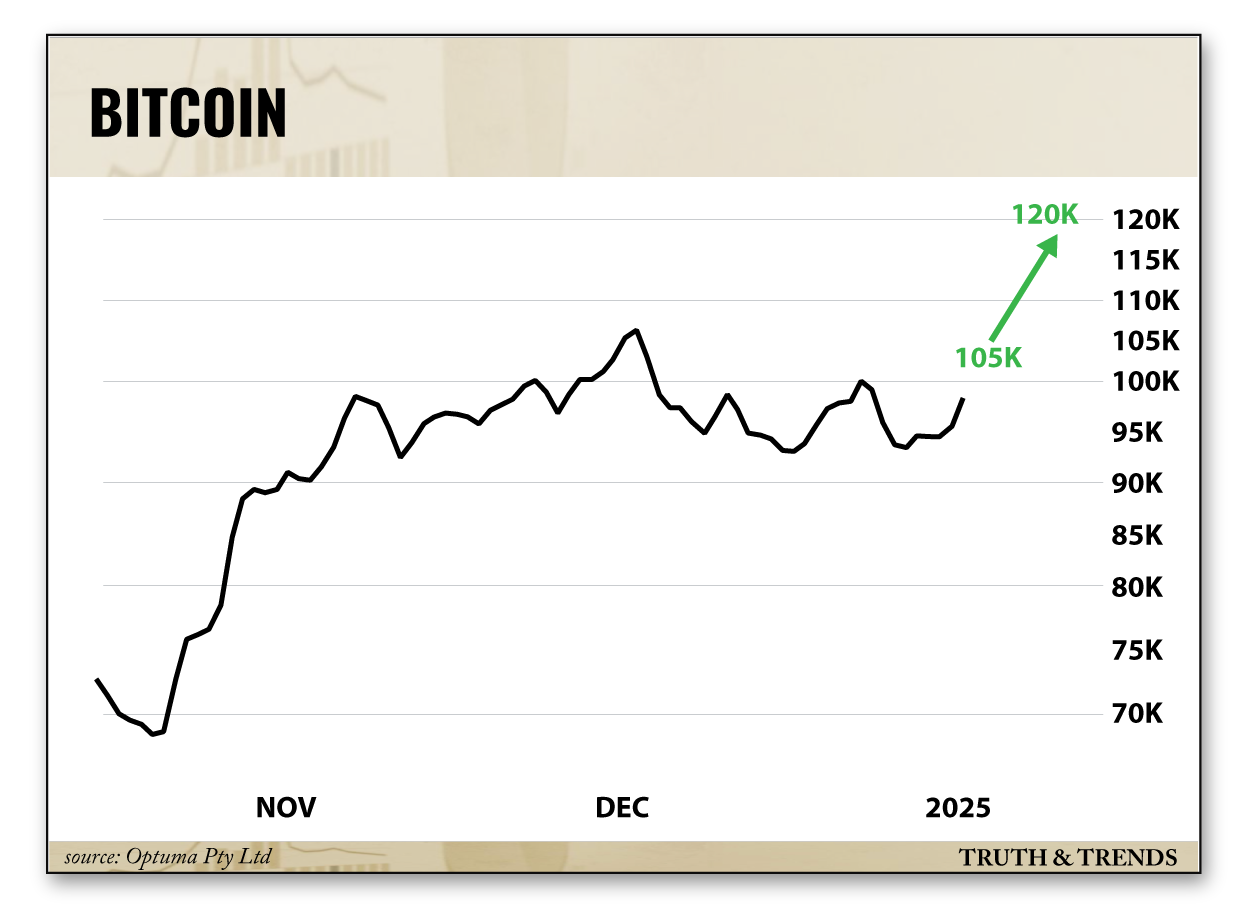

3. Bitcoin’s Next Measured Move Gives Us a $120,000 Target

Bitcoin has essentially traded in a sideways range since late November as it marched to its first breakout above $100K.

Now that it’s beginning to turn higher again, we can begin plotting price targets in anticipation of an upside breakout.

Here’s how I see it playing out…

If Bitcoin can get back above $105K and start to run, it will likely escape this sideways chop and produce a rally similar in magnitude to what we saw in early November when it jumped from the low $70K range to the mid $90Ks.

That gives us approximately $20K of upside from the breakout zone.

I think that makes $120K a reasonable target looking ahead to the late first quarter — maybe even sooner if Bitcoin runs like it did back in Q4.

For now, it looks like it may be crypto’s time to shine while stocks still try and find their footing this year.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

This Feels Like 1999… NOT 2000

Posted February 09, 2026

By Enrique Abeyta

Bad Vibes Everywhere

Posted February 06, 2026

By Greg Guenthner

The Momentum Trade Cuts Both Ways (Silver Edition)

Posted February 05, 2026

By Enrique Abeyta

The Silver Implosion in Slow Motion

Posted February 04, 2026

By Nick Riso

Silver's Swan Dive Is Just the Beginning

Posted February 02, 2026

By Enrique Abeyta