Posted August 29, 2025

By Greg Guenthner

Biotech Bombshell 💣

You won’t believe what I just dug up…

I was performing my usual routine, flipping through charts and running a few screens to get a feel for the upcoming session.

But as I was sorting through lists of bullish setups, I began to notice a strange pattern. Running down the list of new 50-day highs, one particular market sector caught my eye.

Now, it has my undivided attention. And it should have yours, too!

Before I reveal which group I’m talking about, you should know that my scans over the past few months have been mostly predictable. Big-tech stalwarts, crypto-related stocks, and gold and silver miners have dominated my screens along with the usual suspects, travelling up and to the right.

Since the averages bottomed in April following the spring tariff tantrum, we’ve had opportunities to profit from massive trends in the speculative-tech basket plays, in quantum computing, and in AI.

Naturally, not every sector or industry is participating. Losers and laggards are always present – which most traders avoid like the plague. In a rip-roaring bull market, there’s no reason to take your chances on a serial underperformer stuck in a nasty downtrend.

That’s why this strange sector popping up on my scans was so surprising. You see, a vast majority of these stocks haven’t been in play for years. In fact, this group endured a 65% peak-to-trough drop from 2021-2022. It failed to rally when a new bull market emerged in 2023. And it was flat in 2024 despite the major averages posting powerful rallies.

Investors clearly left these stocks for dead.

But many of these stocks are finally firming up and posting compelling base breakouts. In fact, the group is now besting the Nasdaq Composite on one-month and three-month timeframes as it inches closer to breakeven on the year.

All the signs are pointing to a bigger rally in the making. Luckily, it’s early. You still have time to jump on the biotech bandwagon, but these stocks won't remain a secret much longer.

A Fresh Rally in a “Hated” Industry

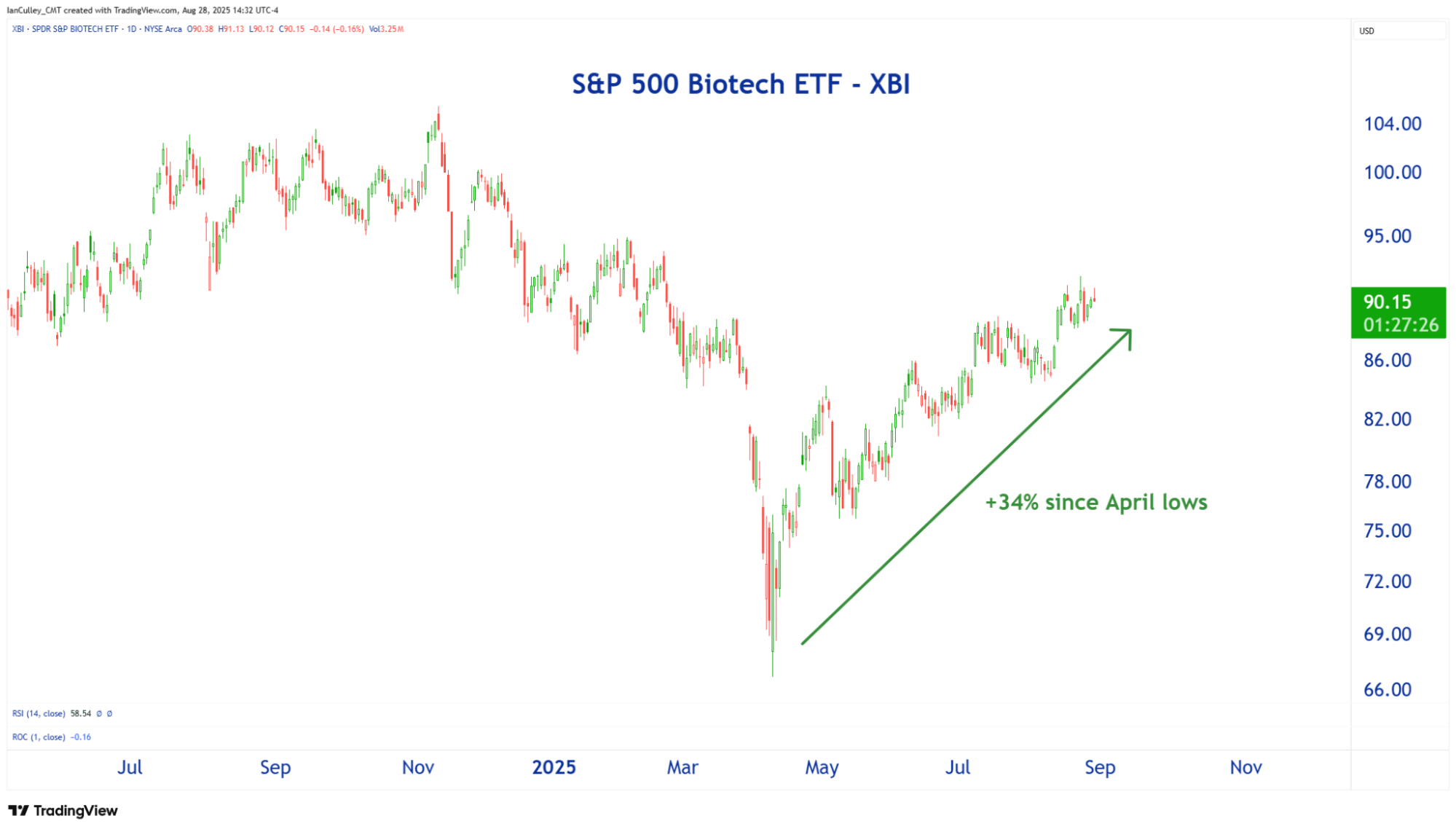

Check out the turnaround action in the SPDR S&P Biotech ETF (XBI):

XBI was down as much as 25% year-to-date during the post-Liberation Day meltdown. Terrible as that may sound, the April meltdown stopped short of retesting its Oct. 2023 lows — a small win for a volatile and downtrodden group of stocks.

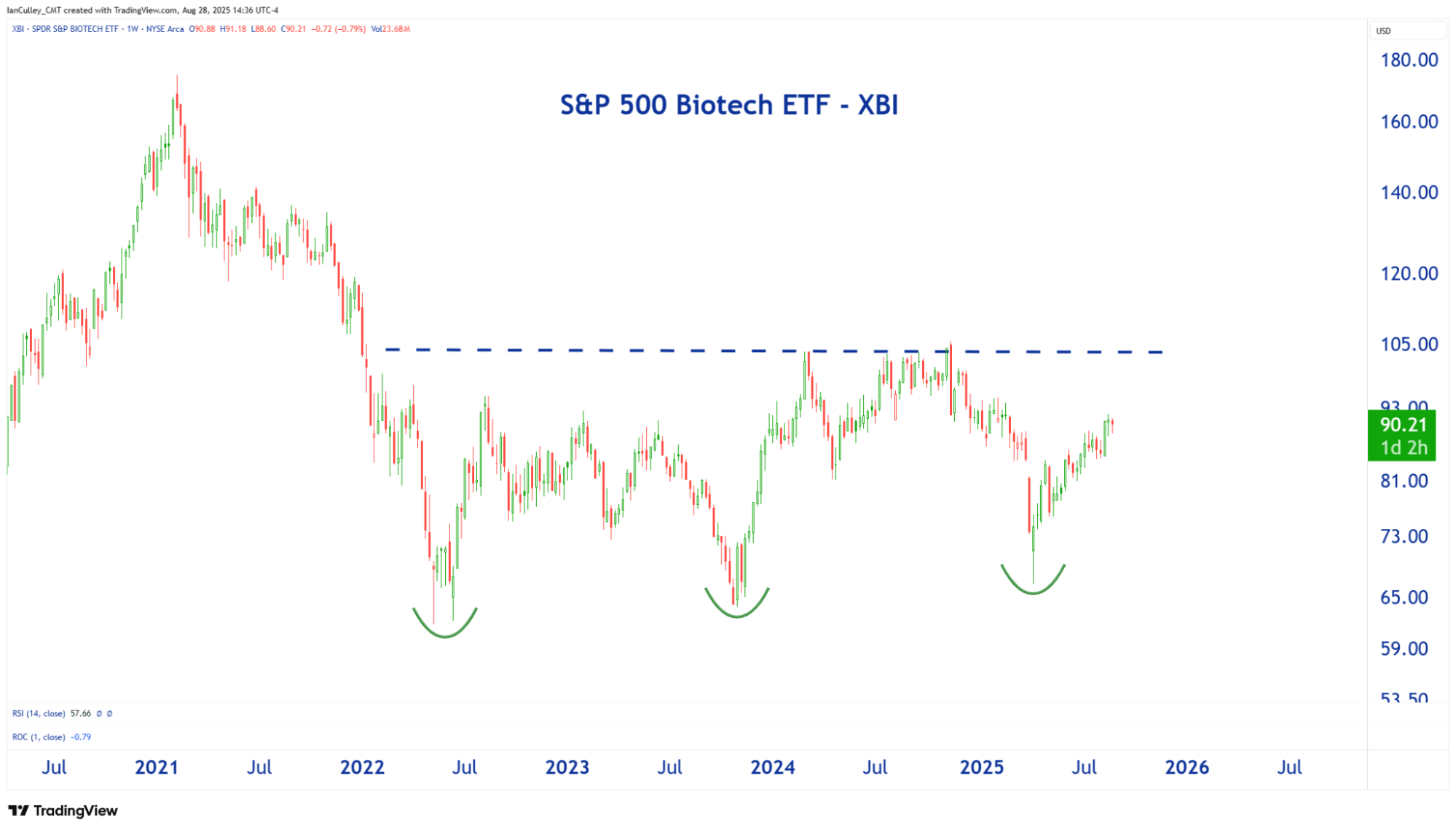

The biotech ETF has since clawed its way back from the dead, clearing its March high earlier this month to reach breakeven on the year. If XBI can continue to firm up and run, we will witness an even bigger, multi-year base breakout in the months ahead. A move above $105 will trigger a potential longer-term rally back to the Covid bubble highs.

Here’s a zoomed-out look going back to early 2020:

So, what biotech stocks are driving this unexpected comeback?

Digging beneath the surface, you’ll uncover a handful of gems that have one thing in common: They’re all medical device companies.

The iShares US Medical Devices ETF (IHI) is by far the best-looking biotech industry group. Unlike its peers, IHI is challenging six-month highs as it carves out a path toward its 2021 peak, as they should!

Think about it…

Any biomedical R&D is dead in the water under Kennedy’s reign and his MAHA movement.

Plus, when your children’s children’s children are rocketing their way to Mars, I bet they’ll have a medical device or two on board — tiny robots maintaining the health and safety of the crew.

IHI holds the companies that put the tech in biotech.

Eye-catching as the stocks are, you’ll still find a dim prospect or two. In fact, IHI's top three holdings — Abbott Labs (ABT) at 18.36%, Intuitive Surgical (ISRG) at 13.56%, and Boston Scientific (BSX) at 11.17% — tell conflicting stories.

ABT and BSX are making a concerted effort to recapture their respective 2021 peaks. While ISRG, on the other hand, seems more preoccupied with its Liberation Day tariffs.

To be fair, ISRG closed at record levels in January. That’s fine – but I’d rather risk my capital with a stock that’s riding high versus a ticker that’s dragging its feet.

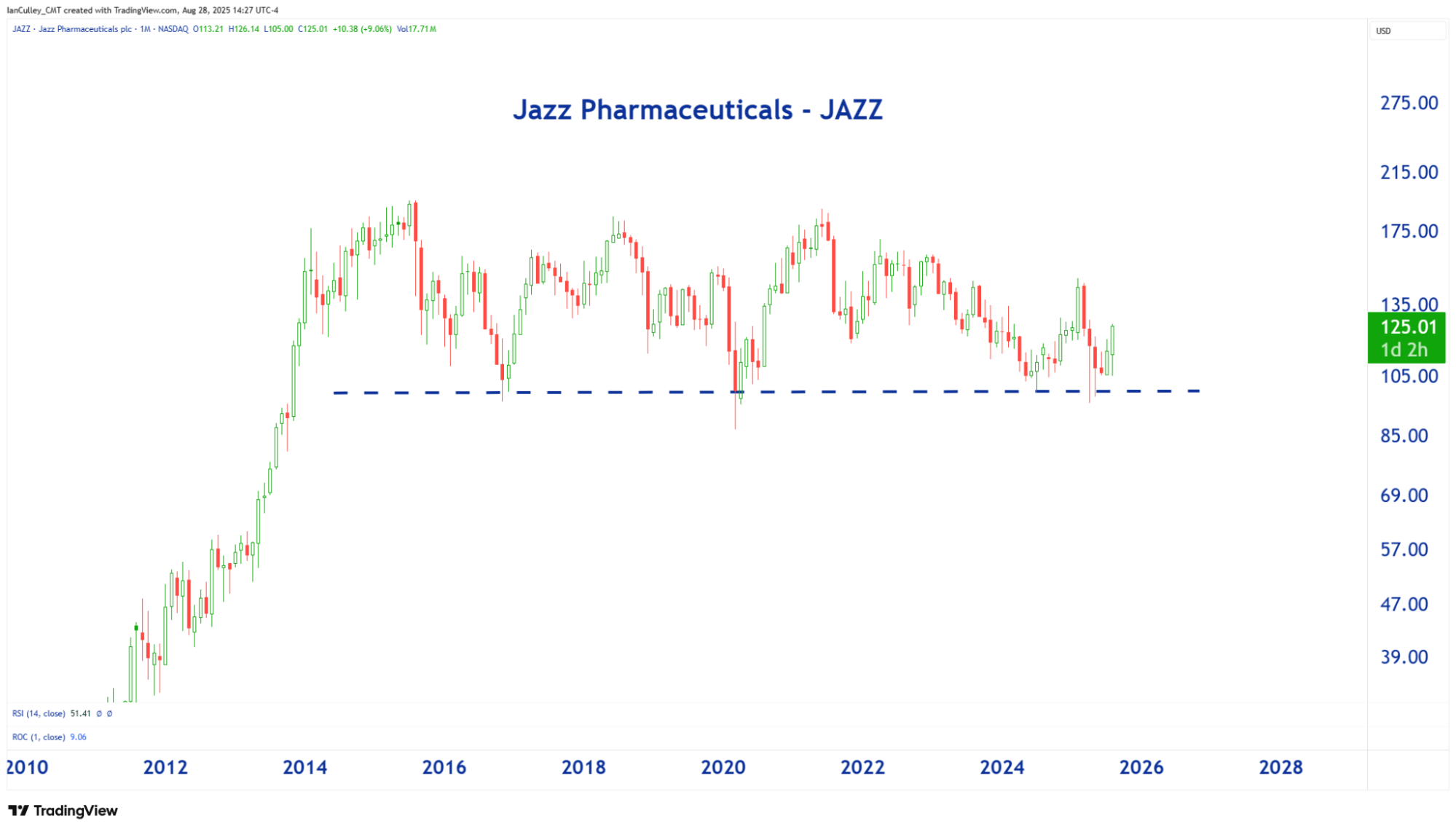

In addition to the medical device names, other “old school” biotech tickers are also beginning to look constructive. One of the names that keeps popping up on my scans is Jazz Pharmaceuticals (JAZZ).

Yes, JAZZ is trading within the lower quadrant of a decades-long range. But it’s also breaking out of a 5-month bullish consolidation. Mind you, a consolidation following a retest of its Covid lows. Remember, this is a stock that’s nowhere near its all-time highs, which were posted all the way back in summer 2015. It’s been dead money walking for ten long years.

JAZZ has plenty of headroom before banging into its mean share price. Of course, I think JAZZ stock will rally well beyond the middle of the road. Shares have already broken above the May highs. If this momentum persists, I expect this long-forgotten biotech to attack its March high near $150 by the fourth quarter.

A Ripping Rotation

Why does a biotech breakout matter?

First and foremost, it’s a positive sign to see rotation into areas of the market that haven’t received a lot of positive attention recently. Biotech certainly fits this bill, since aside from a brief resurgence during the pandemic, many of these stocks have underperformed for close to a decade.

Bull markets thrive on rotation. During these bull market rotations, money will flow into new industries or sectors as leading groups consolidate. That’s exactly what we’re seeing right now, with small-caps, regional banks, and biotech enjoying some newfound attention.

Next, and possibly most importantly, a resurgence in biotechs is not indicative of risk-off behavior. Far from it! The fact that money is rotating into an underperforming and mostly speculative group shows that the hot money isn’t running scared right now, bearish seasonal trends be damned.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Labor Is Capitalism: A Tribute to Work

Posted September 01, 2025

By Enrique Abeyta

Julian Roberston and the Discipline That Built Billions

Posted August 28, 2025

By Enrique Abeyta

Ditch Nvidia Tomorrow Night

Posted August 26, 2025

By Ian Culley

The Tiger's Advice That Still Rings True

Posted August 25, 2025

By Enrique Abeyta

Name That Chart

Posted August 24, 2025

By Ian Culley