Posted May 06, 2025

By Ian Culley

America Bleeds Value

Financial earthquakes shake the foundations of everything you thought you knew about investing. Fifteen years of market certainties now lie shattered.

Asian currencies explode upward. European banks — once a financial wasteland — suddenly blast to record highs, defeating even gold’s magnificent 26% surge. Meanwhile, America’s strongest companies bleed value.

History unfolds before your eyes.

The Taiwanese dollar just delivered its largest two-day surge against the USD since before the 1997 Asian Financial Crisis — a 9% move that obliterated three years of dollar strength in mere hours.

European financial stocks — from the very nations that limped sideways for decades — now outperform the S&P 500 by a staggering 40% in just four months.

These seismic shifts herald the dawn of a new investment era.

Behind these numbers lies an unstoppable force reshaping the global financial landscape. The implications will touch every dollar in your portfolio, every retirement account, every financial decision you make for years to come.

The world’s smartest investors are already positioning themselves accordingly.

The question remains: will you recognize this once-in-a-generation wealth transfer? Before your opportunities vanish?

Let’s talk about it…

All-Time Highs in the Unlikeliest Places

We can all agree that Gold has proven to be one of the best trades so far this year. But the shiny yellow rock hasn’t been the only big winner.

Other market areas, such as European Financials, also post new highs. (That’s not a typo.)

Yes! European banks are giving gold a run for its money.

The iShares European Financials ETF (EUFN) is up four months in a row and more than 31%. Plus, it’s posting new all-time highs!

(Let that sink in for a moment.)

An ETF holding bank stocks from some of the PIIGS (Portugal, Ireland, Italy, Greece, and Spain) — the worst offenders during the European Sovereign Debt Crisis — is handily outperforming the U.S. stock market benchmark by almost 40% since Jan. 1.

I have to admit, I didn’t see it coming from some of the worst stocks in Europe, especially following 10-plus years of dreary returns.

From May 2011 to the end of last year, EUFN rose 58% compared to SPY’s 331% climb.

Can you imagine? …58% over 14 years.

Unfortunately, the same poor performance broadly applies to European equities, albeit to a lesser degree.

UK stocks chopped sideways for twenty years. And the German DAX’s pre-COVID peak sat a mere 70% above its dotcom bubble high.

Europe undoubtedly has its problems, but its market woes were largely due to U.S. strength.

Why would anyone buy the DAX instead of owning the Nasdaq — the greatest companies in the world? It was a no-brainer for individual investors and money managers.

However, that’s no longer the case.

Headlines like European Banks Post Record High suggest two things…

Investors outside the United States are moving their money closer to home, and markets are rewarding them for doing it.

That’s bad news for U.S. investors with a home-country bias. Think about it…

If European stocks continue to hit all-time highs, why would anyone want to buy the Nasdaq?

A Three-Year Uptrend Erased in Hours

If it hadn’t been for Warren Buffett’s retirement over the weekend, the Taiwanese dollar (TWD) would have stolen the show yesterday.

The U.S. dollar dropped roughly 6% against the TWD by Monday morning. This was on top of a 4% decline last Friday.

It might not sound like much in terms of growth stocks. Palantir Technologies (PLTR) slid over 12% today alone. It happens.

But a 9% loss in two days can be catastrophic for a currency pair.

Check out the USD/TWD (US dollar vs. Taiwanese dollar) chart…

The U.S. dollar’s three-year uptrend was wiped out in a few short days.

In fact, yesterday’s selloff in the USD/TWD outpaced its largest one-day drop following the 1997 Asian Financial Crisis by almost 2%!

Don’t get me wrong. I don’t think we’re in the midst of a financial crisis.

However, the weakening U.S. dollar is undoubtedly driving foreign investors away from America.

I doubt this USD/TWD move is a one-off. An unstable USD increases the likelihood of extreme price swings across bonds, stocks, and commodities, too.

Perhaps the S&P 500’s recent string of nine up-days in a row pales in magnitude to the USDTWD move, but we haven’t seen SPY run like that in 20 years.

I expect bouts of upside and downside volatility will become the norm if the world’s reserve currency can’t find its feet.

The sell-America trade is real, and it’s leaving the station.

All aboard!

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Silver's Swan Dive Is Just the Beginning

Posted February 02, 2026

By Enrique Abeyta

Lightning Round: Trump’s Fed Pick, the Silver Crash, and More

Posted January 30, 2026

By Greg Guenthner

Forget the Noise, You're Not Bullish Enough

Posted January 29, 2026

By Enrique Abeyta

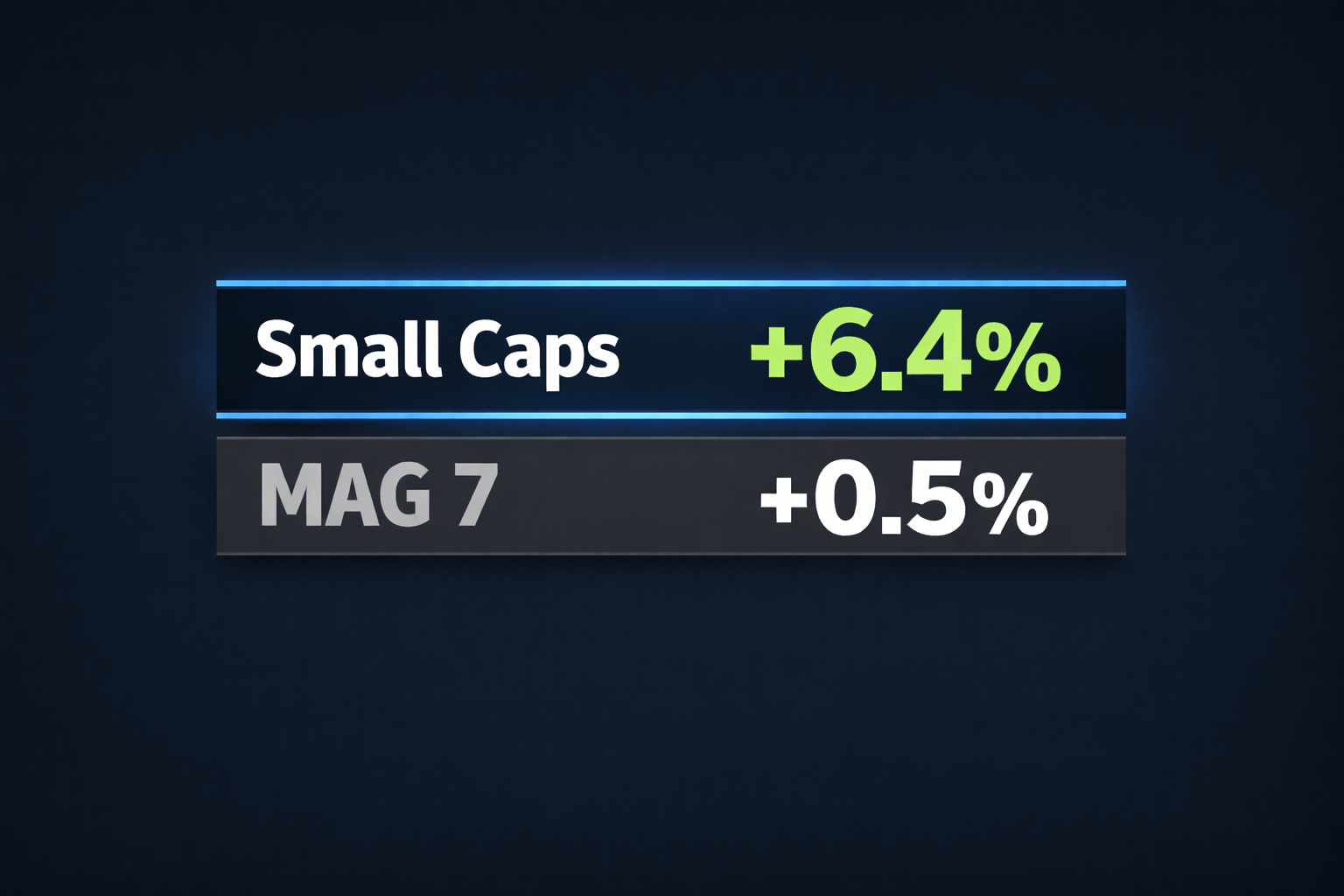

Small Caps Are Back, Baby!

Posted January 23, 2026

By Greg Guenthner

Greenland, Carry Trades, and Lazy CNBC Takes

Posted January 22, 2026

By Enrique Abeyta