Posted July 08, 2025

By Ian Culley

A Beach Bum’s Guide to Crypto Summer

I’m kinda scared of crypto right now…

Those were the words of my cousin, Robbie, yesterday afternoon as we sat around a pile of steamed shrimp and crab legs.

Every year, my extended family from across the southeast descends on Pensacola’s white sand beaches. The cousins run in packs, fishing, paddleboarding, and tubing along the Intracoastal Waterway.

And, of course, there’s the Blue Angels air show.

We only see each other a couple of times a year, so it doesn’t take long for family members to pry a market take or two from me.

Wearing my analyst cap, I was surprised to hear Robbie’s reluctance toward crypto, given Bitcoin's close proximity to record highs. But as a crypto bull, I loved it!

You can file “scared” under Key Words You Don’t Hear at a Market Top.

But just a few minutes later, he began to rave about his Constellation Energy (CEG), D-Wave Computing (QBTS), and Joby Aviation (JOBY) positions, claiming multiple triple-digit winners.

I put my beer down and cocked my head like a confused golden retriever…

You mean to tell me you’re trading modular reactor names and flying car stocks, but you’re scared of crypto?

Against my better judgment, I felt an immediate need to explain why I’m betting on a crypto bull run.

Compressed Volatility at Record Highs

Bitcoin is preparing for blastoff. The crypto king has quietly churned within a tight seven-week range just below record highs.

The distance from a new all-time high, combined with compressed volatility, will likely lead to a Bitcoin breakout that will kick off the next leg higher for cryptocurrencies across the board.

Check out Bitcoin’s Bollinger Band (BB) width in the lower pane:

Bollinger Bands measure volatility by identifying two standard deviations above (upper band) and below (lower band) price over a particular look-back period (in this case, 14 trading days).

Remember, volatility expands as asset prices trend and compresses as prices correct or consolidate. The BB width indicator registers these ebbs and flows in volatility and price.

Notice Bitcoin’s BB width is reaching the lower end of the past 18 months. Volatility is ice cold, so the next move, up or down, will be explosive. (I’m leaning toward up.)

Buyers are chipping away at those former all-time highs as the $108-110K zone attracts price action like a magnet.

Based on the speculative froth surrounding quantum computing, robotaxis, and nuclear energy names (all the stocks my cousin Robbie has no problem trading), it’s only a matter of time before the animal spirits reach Bitcoin.

I wouldn’t be surprised if Bitcoin blasts to a new all-time high by the end of the week.

If and when it does, pessimism will give way to optimism. Bulls will be lured back to the crypto market. And a rip-roaring crypto rally will finally get underway.

Early Inning Action

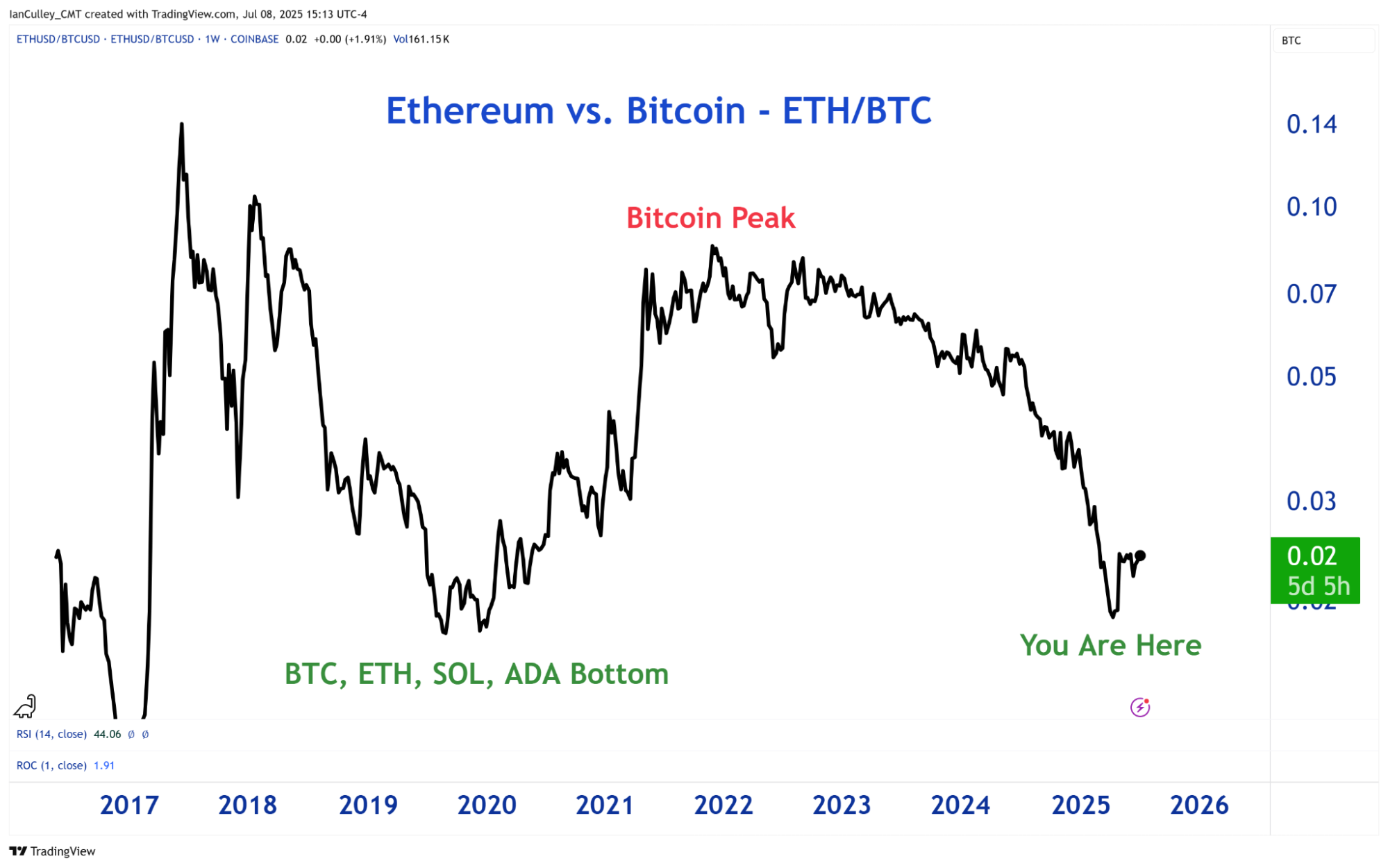

I look to the Ethereum (ETH) vs. Bitcoin (BTC) chart as a risk gauge for the crypto market.

ETH outperforming BTC (black line rising) signifies a risk-on environment, while BTC outperforming ETH (black line falling) indicates a lack of enthusiasm among investors.

During the last cycle, Bitcoin, Ethereum, and other altcoins, such as Solana (SOL) and Cardano (ADA), notched their lows when this ratio bottomed in March 2020.

On the other hand, the broader cryptocurrency market reached its peak a few weeks prior to the ETH/BTC ratio's peak.

Today, the ratio is bouncing off a multi-year low, not far from the darkest days of the COVID-19 selloff. These are levels associated with cyclical lows.

Meanwhile, Bitcoin is trading at $108k, hinting at a new all-time high.

And altcoins? They’re light years away from their respective record highs.

ETH is still stuck in a 45% drawdown. Solana, a darling among altcoin enthusiasts, is trailing at a similar distance. And ADA maintains a staggering 80% drop from its 2021 peak.

The crypto bull run has yet to begin.

Indeed, Bitcoin has experienced a steady climb since reaching record highs in March 2024. But it has done it alone. The altcoins that managed to participate in the rally failed to sustain their momentum for long.

(This doesn’t sound like a market top to me.)

Smaller coins have been experiencing a chronic case of absenteeism. Perhaps that’s why investors are choosing to focus on equity markets instead.

Ultimately, the speculative fervor for growth stocks will likely spill over into cryptocurrencies.

A Bitcoin breakout will be your first indication that the tide is turning in favor of crypto markets.

As volatility expands, you’ll want to see Ethereum get moving. Once ETH begins to outpace BTC, you’ll start to notice altcoins kicking into high gear.

By then, I imagine all my cousins will be asking for my favorite coins.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Sober Up! Traders Are Drunk on Gains

Posted July 11, 2025

By Greg Guenthner

4 Trading Habits You Can Start TODAY

Posted July 07, 2025

By Enrique Abeyta

I Dumped HALF My HOOD Shares

Posted July 04, 2025

By Greg Guenthner

STOCK WARS: Independence Day Edition

Posted July 03, 2025

By Enrique Abeyta

![[Breakout Confirmed] This 10x Trade Is Taking Off](http://images.ctfassets.net/vha3zb1lo47k/5SZCYl7OZbRTZpXv6ItiqQ/fcc3fb7ac31039e02a1e4ef1ff161ca5/ttr-issue-07-01-25-img-post-2.jpg)

[Breakout Confirmed] This 10x Trade Is Taking Off

Posted July 01, 2025

By Ian Culley