Posted January 06, 2025

By Enrique Abeyta

5 Surprises That Will Rock 2025

Welcome to the first full trading week of 2025!

To kick things off, I want to share some surprising predictions for the new year.

I’m talking about out-of-consensus views that are both possible and probable.

Remember that, like stock picking, making predictions is about probability. There are no guarantees.

Nevertheless, these outcomes will surprise a lot of folks, and I want you to be prepared.

So let’s go…

1: The Mag 7 Will Outperform Again (Except Nvidia)

After two years of exceptional performance, the “smart money” is saying that the Magnificent 7 can’t do it again. Well, I disagree!

Below is a table showing the performance of the individual members in both 2023 and 2024.

After back-to-back annual returns like this, why do I think these stocks will outperform again?

It’s simple: They’re incredible companies. They have massive scale, competitive moats, and huge competitive advantages.

There’s a reason why they’ve performed so well over the past couple of years, and I think they can do it again.

Now, I know many people out there will disagree. So it will be a big surprise if things go how I anticipate.

Perhaps more surprisingly, I believe that the market’s favorite stock, Nvidia (NVDA), will lag in 2025.

That’s because we’re moving from the network-building phase of the AI boom to the implementation and harvesting phase. So investment will shift from hardware to software.

The shift could set Nvidia up for disappointment, especially after two tremendous years that have set extremely high expectations.

On the other side, companies that have spent money on building the network — Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOG), and Meta Platforms (META) — will see their capital expenditures lessen.

This could lead to an explosion in earnings and cash flow at these companies, powering the Mag 7 to greater heights while leaving Nvidia behind.

2: Small-Caps Will Continue to Struggle

The second most popular prediction for 2025 (after Mag 7 underperformance) is that small-cap stocks will finally start to pull ahead of the large-caps. Again, I disagree.

There are particularly good reasons why small caps have underperformed over the last few years, and those won’t change in 2025.

These are sub-scale companies with inferior balance sheets and more exposure to macroeconomic variables like inflation, interest rates, and commodities.

This doesn’t mean small caps will go down in 2025. I just doubt they will keep up with their larger brethren.

Sometimes, stocks are cheap for a reason. That reason will not change anytime soon for small-cap stocks.

3: Interest Rates and Inflation Won’t Matter

After two years of dominating the headlines and creating volatility, I think that movements in interest rates and inflation won’t matter much to the stock market this year.

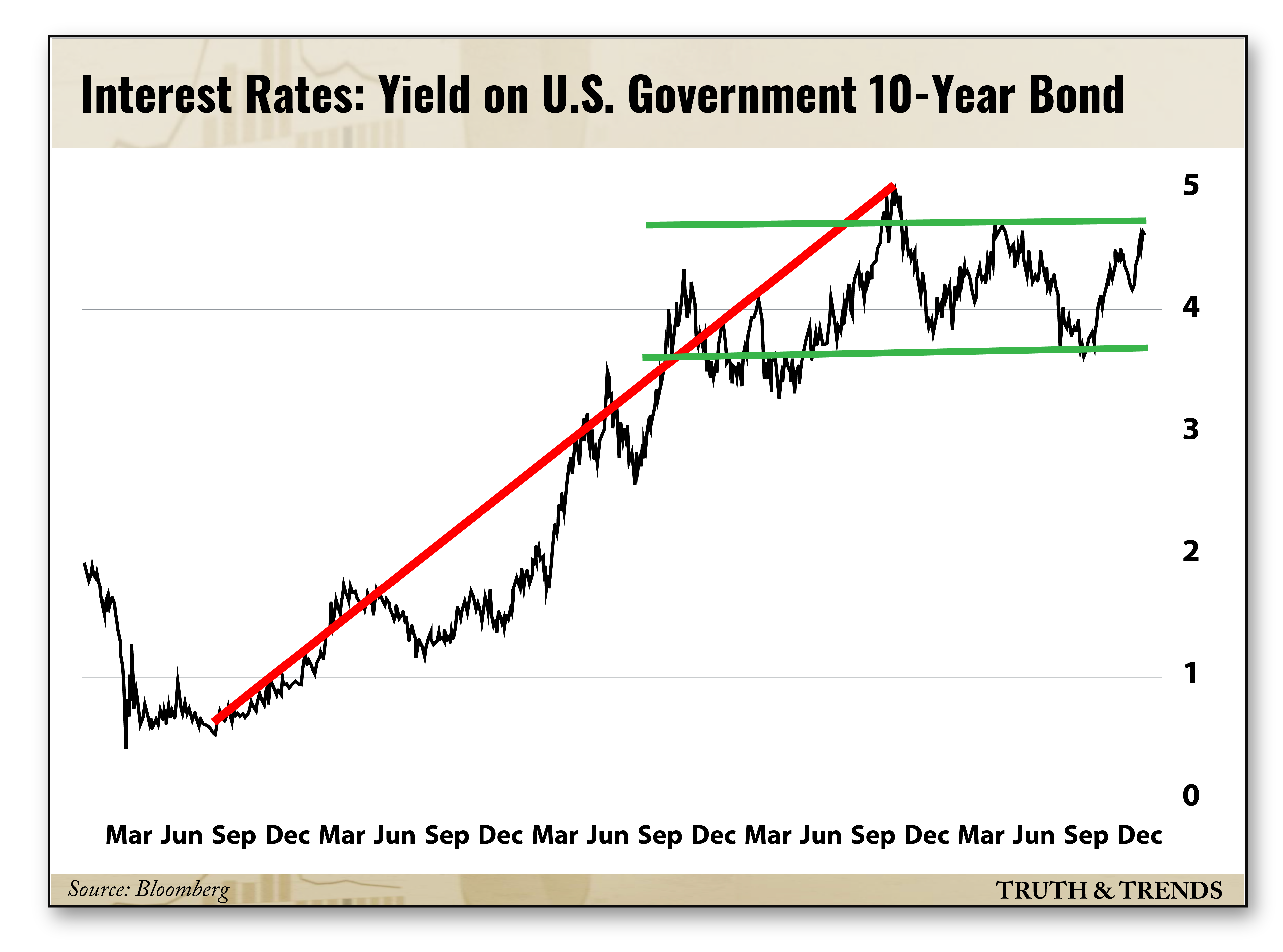

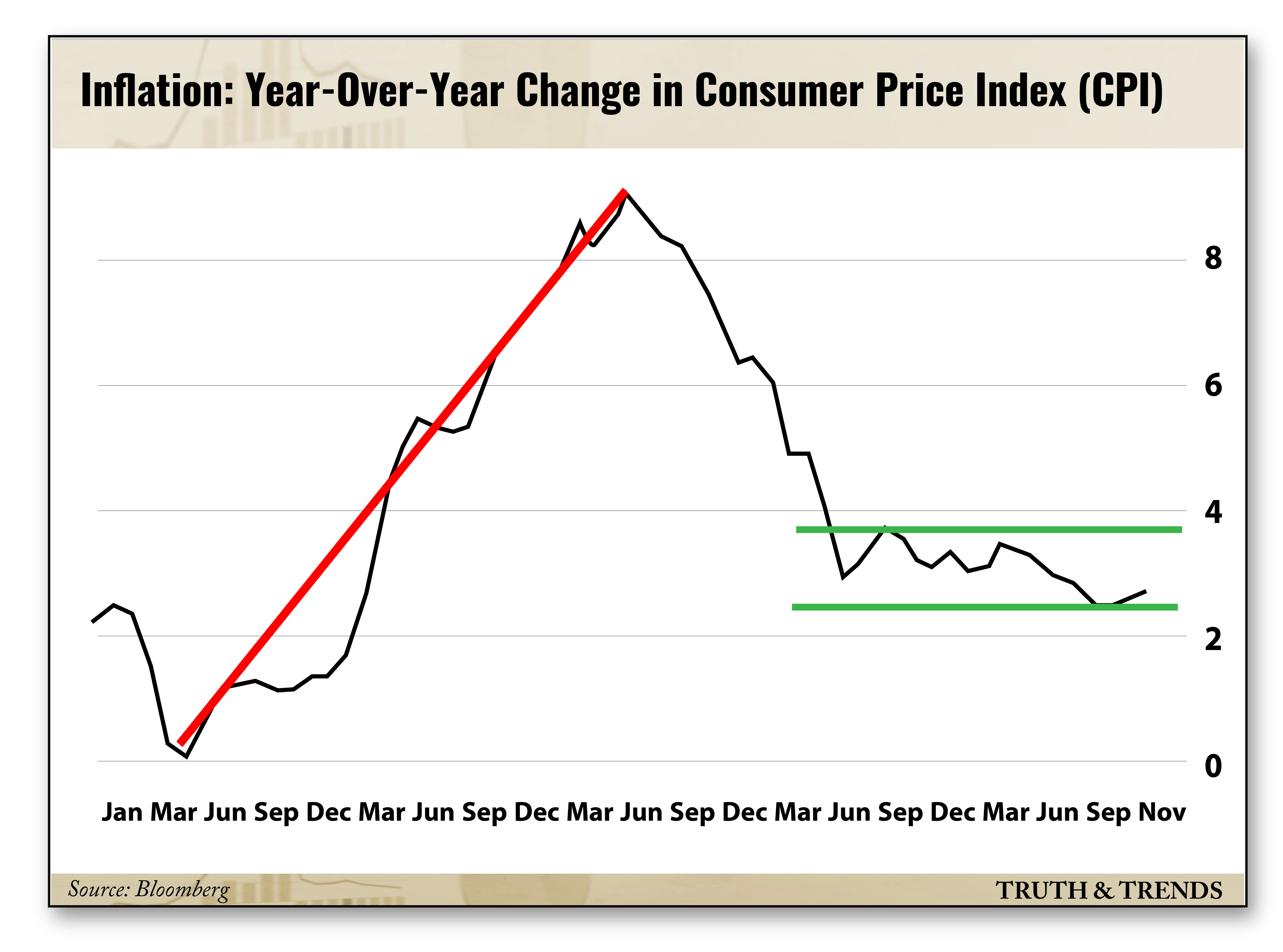

The reason these variables had so much influence in the last few years is that we were quickly going from exceptionally low levels in each to much higher levels (highlighted by a red line in the following charts).

Here’s a chart of the U.S. 10-year Yield…

And a chart of the Consumer Price Index (CPI) year-over-year percentage change…

The period of jarring inflation and interest rate increases is now over. I think that both variables have settled into a range (highlighted in green) from which they are unlikely to depart in 2025.

They’re not moving up (or down) enough to create any real volatility. They’re also not so high that they really matter.

The media wants you to click, or they don’t get paid. So you’ll probably hear a lot about both inflation and interest rates in the year ahead.

But I think you can ignore these variables in 2025 (much like most of the 1990s).

4: The Stock Market Goes Up a Lot (or a Little)… But NOT Down

After two years of strong stock market performance, many are predicting a down year for stocks. And the third year of a bull market is traditionally the weakest or even down.

I think statistics like that are interesting. But when looking at the stock market's direction, you want to focus on earnings.

If earnings grow, then the stock market is likely to go up.

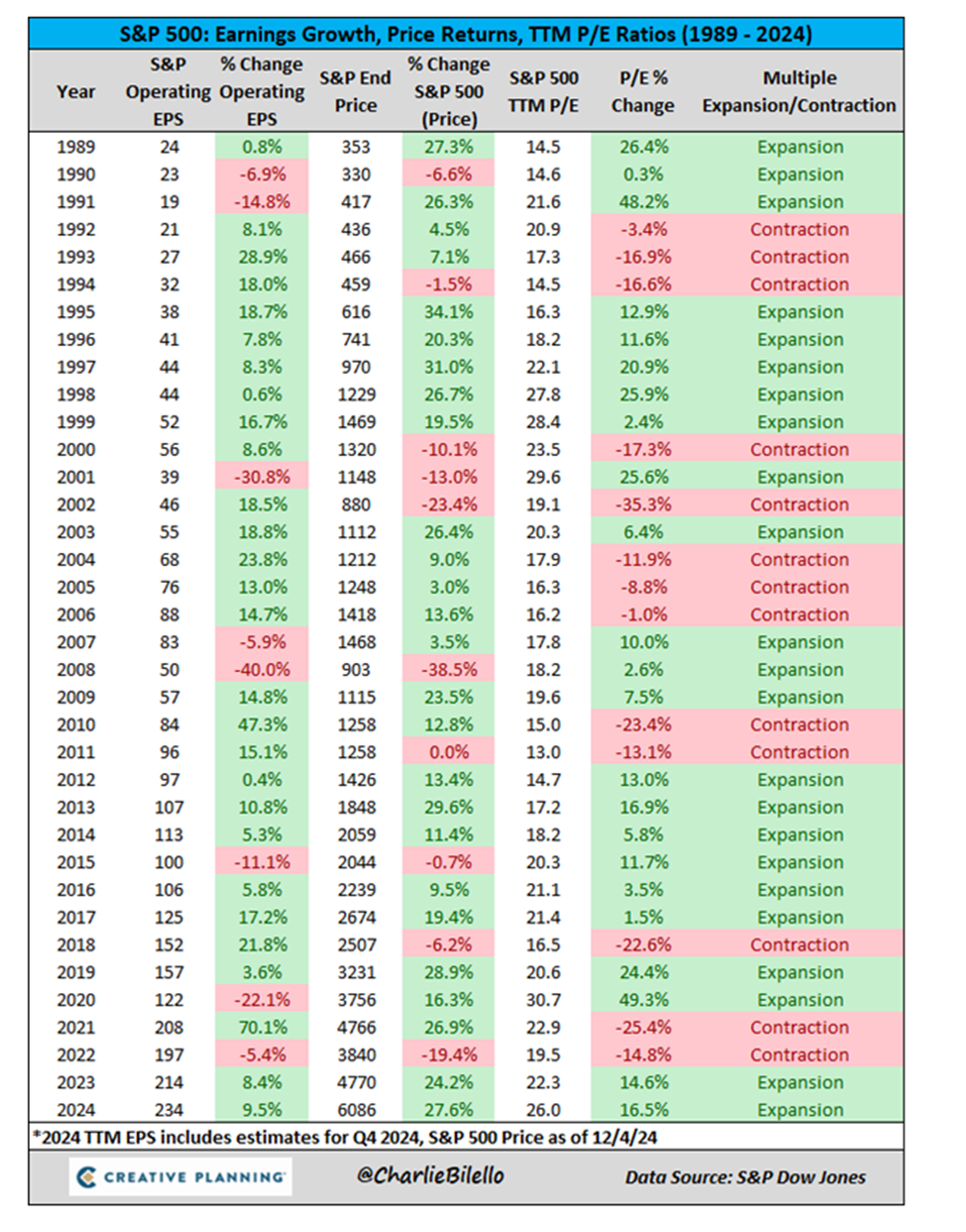

Here’s a table from Charlie Bilello I shared on our live call at The Maverick a few weeks ago.

On the chart, you can see that there’s a high correlation between growth in earnings at the S&P 500 and price performance. Valuation didn’t matter.

Steady interest rates, inflation, and commodity prices combined with an accommodative monetary and fiscal policy indicate earnings will likely grow over the next year.

Maybe they grow more or less than current expectations, but I expect them to grow. If they grow, then stocks go up.

The surprise may be that they only go up slightly (say, less than 10%) as we have a choppy stock market.

Or maybe they go up a lot (greater than 30%) as we revisit the melt-up environment of the late 1990s.

Either way, I don’t think the stock market will drop in 2025.

5: Bitcoin Hits $250K

While it might have felt like 2024 was the year of Bitcoin as its price broke above $100k, I think 2025 will take it to another level.

With broader institutional adoption, purchase by sovereign nations as a reserve, and increased public acceptance, I think it can trade above $250,000.

This may seem like a lot now, but I actually think it’s headed to $1 million in the next few years. So this is just a small step on the journey!

I may be proven right, or I may be wrong. But never let it be said that I’m afraid to take a stance on the market!

Hopefully, my predictions will help you rethink what is possible this year. Now, let’s go out and make some money.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

The Iran War: What’s Next for Stocks, Oil and More

Posted March 02, 2026

By Enrique Abeyta

It’s Not Just You, This Market Is Mind-Melting

Posted February 27, 2026

By Greg Guenthner

Israel, India and Iran: The Calm Before the Strike

Posted February 26, 2026

By Enrique Abeyta

Tariff Tantrum Redux

Posted February 23, 2026

By Enrique Abeyta

The Weight of Nothing

Posted February 20, 2026

By Nick Riso