Posted January 24, 2025

By Greg Guenthner

3 Old-School Stocks Putting Nvidia to Shame

All eyes are on tech stocks.

CES hype, earnings expectations, and visions of fresh breakouts are clogging investors’ brains this month.

Everyone’s waiting for the next Magnificent Seven standout or Nvidia to finally shake off the cobwebs and jet to new highs.

But here’s the thing…

Tech’s not leading the market right now. It’s not even close.

The Technology Select Sector SPDR (XLK) is up approximately 3% so far this month. Not too shabby, but market rotation is afoot.

If you want to keep up, you need to get tech off your mind and start poking around other areas of the market — like industrial stocks.

Bang-up earnings are rolling through the sector, which is leading to strong moves in some of the biggest household industrial names.

In fact, the Industrial Select Sector SPDR (XLI) is more than doubling the performance of XLK so far this month, gaining an impressive 6.3% as of Thursday afternoon.

These stocks may not be as flashy as the big tech names, but you simply can’t afford to ignore them any longer!

Today, I’ll show you three in particular that you should absolutely be watching right now.

Old Name, New Trend

Over a century before Nvidia and the AI craze, investors traded General Electric and a novel life-changing technology: the light bulb.

Few publicly traded stocks can tout roots to Thomas Edison. (Talk about staying power.) But the industrial bellwether isn’t the same multinational conglomerate it was at the turn of the century. In fact, it’s not the same company it was five years ago!

Last year, it finalized a split into three separately traded companies, one focused on healthcare, another on energy, and the final on aerospace.

I’m sure they’re all great companies, but you want to pay attention to GE Aerospace (GE).

For starters, it kept General Electric’s original ticker. That’s a big bonus in my book. Old-school names need old-school tickers.

On top of that, it’s the former aerospace segment of the company, which automatically makes it cooler than the healthcare and energy spinoffs.

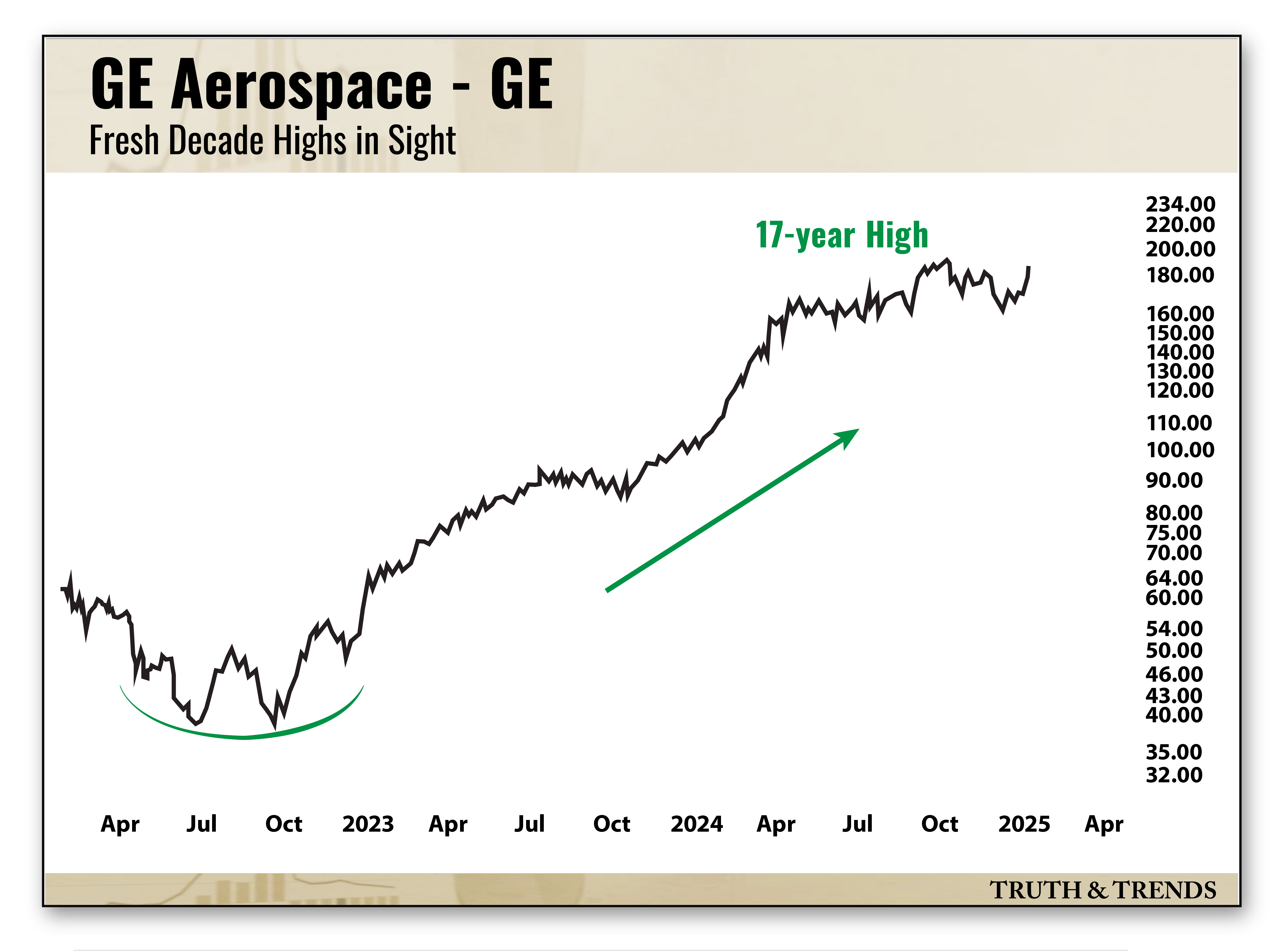

But most importantly, the chart looks amazing.

GE has gained more than 400% since bottoming in July 2022. Following a little sideways action after a new 17-year high last fall, buyers are storming back into the stock after it announced strong earnings earlier this week.

The stock gapped higher to post its highest close since July 2001. It’s now up 20% year-to-date, putting the big tech stocks to shame.

Buyers Flip the Script

While 3M (MMM) doesn’t go back as far as GE, it certainly has a history. Unfortunately, it’s a history the company would like to forget.

3M has been one of the leading manufacturers of polyfluoroalkyl substances since the 1950s. These chemicals are commonly referred to as forever chemicals or PFAS. You can’t escape them. They’re the micro substances found on every surface on earth, from the water we drink to the peak of Mount Everest.

For this reason, I like to throw 3M in the same bucket as dirty energy. I guarantee my cousin who refuses to own shares of Exxon would protest buying MMM too.

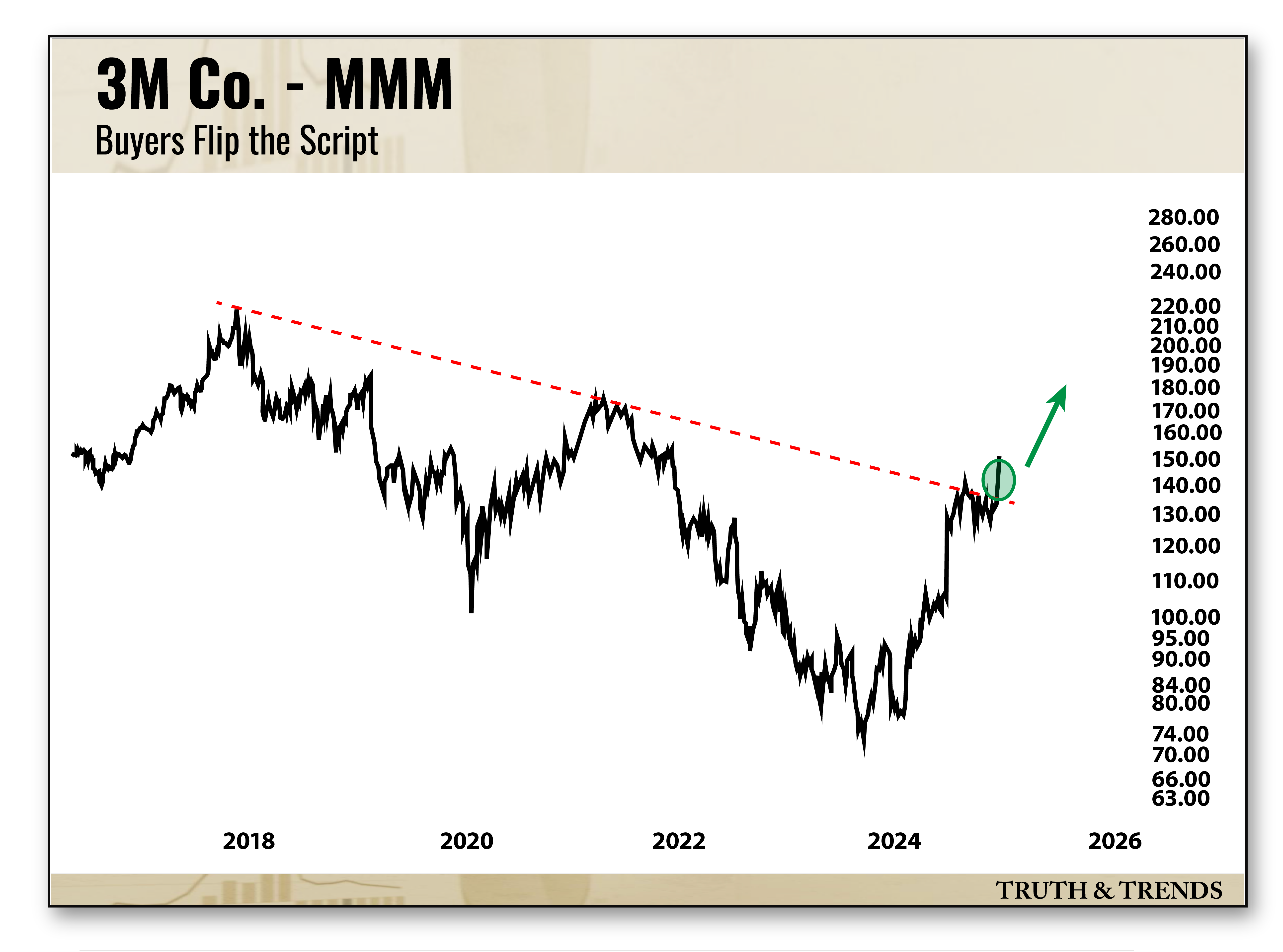

Regardless of whether you deem MMM a viable investment, it’s an $82B industrial stock. Plus, buyers are buying.

Earlier this week, MMM ripped through a seven-year downtrend following an impressive earnings call. Major trendline breaks like this kick off structural trend reversal.

Now, I like high-flying tech stocks just as much as the next investor. But for the overall market, it doesn’t get more bullish than an old-school industrial name entering a new structural uptrend.

And like it or not, it’s up 16% so far this year.

Bust Out Your Picks and Shovels

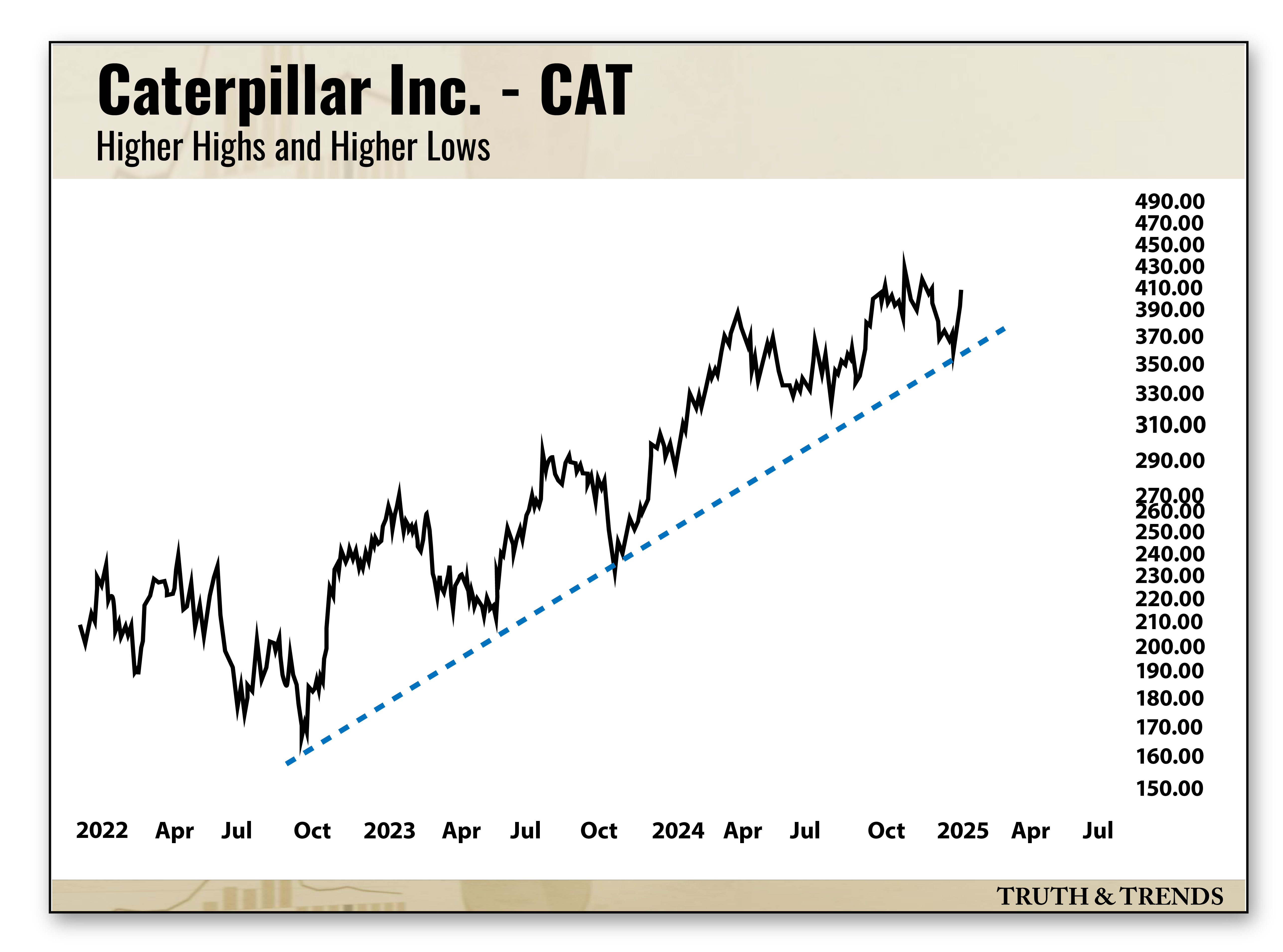

The digital age might run on technology, but the global economy relies on industrial giants like Caterpillar (CAT).

You can think of CAT in the same light as Dr. Copper (infrastructure, growth, demand for raw materials). It’s hard to have a bearish outlook if Caterpillar stock is trending higher.

Check it out — up and to the right since the October 2022 low.

Unlike MMM and GE, Caterpillar has yet to report earnings. It’s due to deliver last quarter’s number next Thursday morning.

However, buyers aren’t wasting any time.

CAT shares jumped almost 10% last week and tacked on another 2% yesterday.

I know I should probably care more about what went down at CES or the latest Nvidia news. But the market is telling me otherwise.

Earnings season is taking off without a hitch, sector rotation is turning in favor of old economy stocks, and Caterpillar is posting new all-time highs.

Give Nvidia and the tech trade a break. It’ll be back to rip-roaring highs before you know it.

Remember, we’re in a bull market.

So check out those overlooked industrial names and get ready for potential blockbuster earnings reports.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

Israel, India and Iran: The Calm Before the Strike

Posted February 26, 2026

By Enrique Abeyta

Tariff Tantrum Redux

Posted February 23, 2026

By Enrique Abeyta

The Weight of Nothing

Posted February 20, 2026

By Nick Riso

“Luck Is Not Real”

Posted February 19, 2026

By Enrique Abeyta

The S&P 500 Lies

Posted February 18, 2026

By Nick Riso