Posted February 20, 2025

By Enrique Abeyta

15/15: This “Perfect Stock” Checked Every Box

In trading, perfect setups are rare. But when they appear, the reward is high.

Over my 30 years of investing professionally, I have developed a proprietary system that helps me identify these opportunities.

This system rates stocks on a basis of 15 points, looking at both fundamentals and technicals.

Perfect "15/15" trades don't happen often. Fewer than 3% of the 1,300+ companies I track ever score this high.

Rare as they may be, stocks that rank this well on my system are some of the most reliable bets you could possibly make.

So when I see one, I know it's time to move.

Today, I want to pull back the curtain and show you how this system works.

Anatomy of a Perfect “15/15” Trade

Let’s use a real example from our flagship trading service The Maverick to show you how these trades can work.

We launched this service last November. So far, we closed 10 trades – 9 of them winners.

A company we recently recommended, the insurance broker Brown & Brown Inc. (BRO), is one of the rare stocks that scores a perfect “15/15” on my system.

As I mentioned, this system scores stocks on both technical and fundamental factors. What are the basics of our system and the scores?

Let’s go through the first group of scores, which focuses on technical analysis.

First, I only look at companies with at least a market capitalization of $2 billion using this system.

The methodology works on smaller stocks, but I find that larger stocks with more analyst coverage give us more data. With more data, we can make higher probability bets.

This market capitalization is the first of the points that we assign.

The following three points have to do with how the stock has been performing recently.

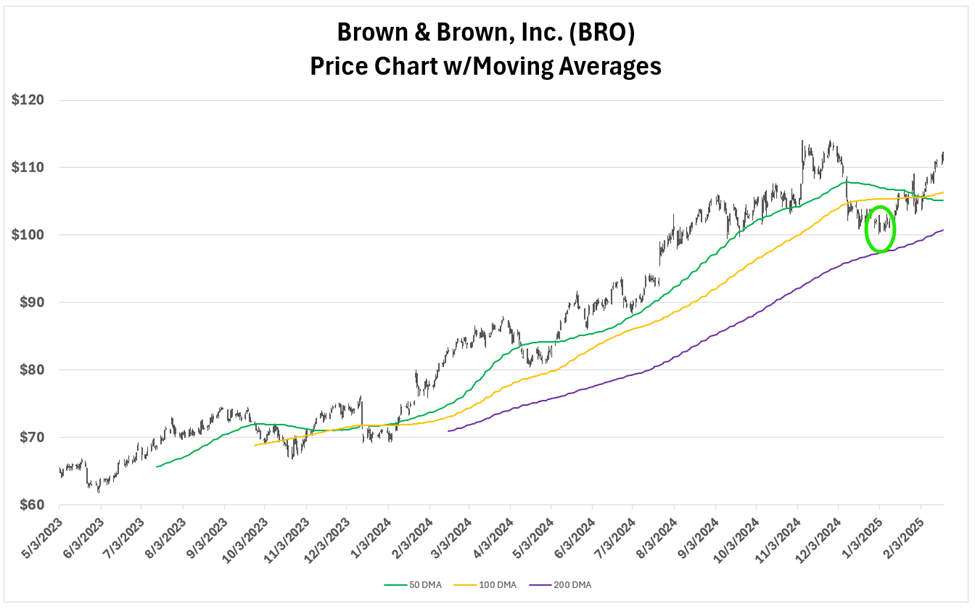

We are looking for stocks in a well-established uptrend. The 50-day and 100-day moving averages must be above a rising 200-day moving average.

If it passes our moving average test, we assign another three points to the stock.

Here was the chart of BRO when we made our buy recommendation to our readers in early January.

On the chart, I have marked where we made our recommendation. It is also clear how the moving averages fit our criteria.

Once I identify a stock in an uptrend, I ONLY get interested if that stock becomes deeply oversold and begins to recover.

This is the next and most important point in our entire system. How do I make this determination?

Wait for This Key “Buy” Signal

I’ve written in previous issues of Truth & Trends that I use a popular technical indicator called the relative strength index (RSI).

To quickly summarize, RSI measures the velocity (or how fast) a stock is moving. It then calculates a score between 0 –100.

A score above 70 indicates that the stock has gone up a lot and there is a ton of investor enthusiasm.

Stocks that have very high RSIs aren’t necessarily shorts, but they most often take some time off before moving higher.

The more powerful signal is when a stock trades below an RSI of 30. This means it has sold off rapidly and indicates some degree of investor panic.

With high-quality companies — and ones where the stock is in a well-established uptrend like BRO — buying after it trades below this level is a high-probability bet.

In particular, I wait for the RSI to go back above that 30 level.

This indicates to us that the investor panic has begun to subside. The reality is that when investors freak out and drive a stock lower, we don’t know when that will stop.

But we can look at the RSI and get an idea of when it does begin to recover.

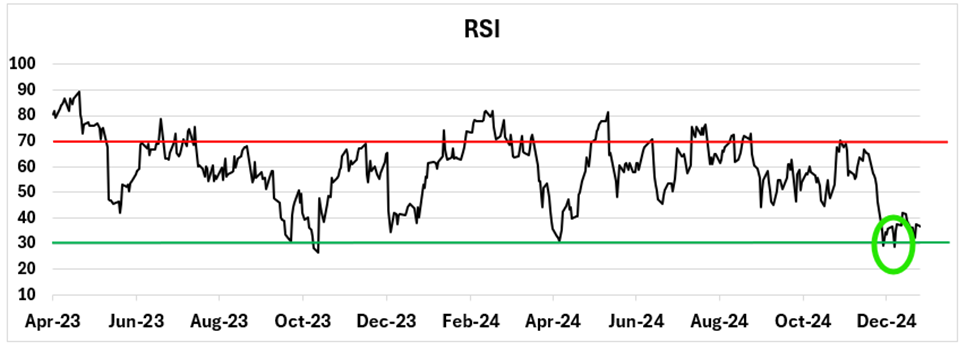

Here is the chart of the RSI of BRO back when we made our buy recommendation.

On this chart, you can see clearly that BRO did exactly what we look for and traded below an RSI of 30 and then back above it.

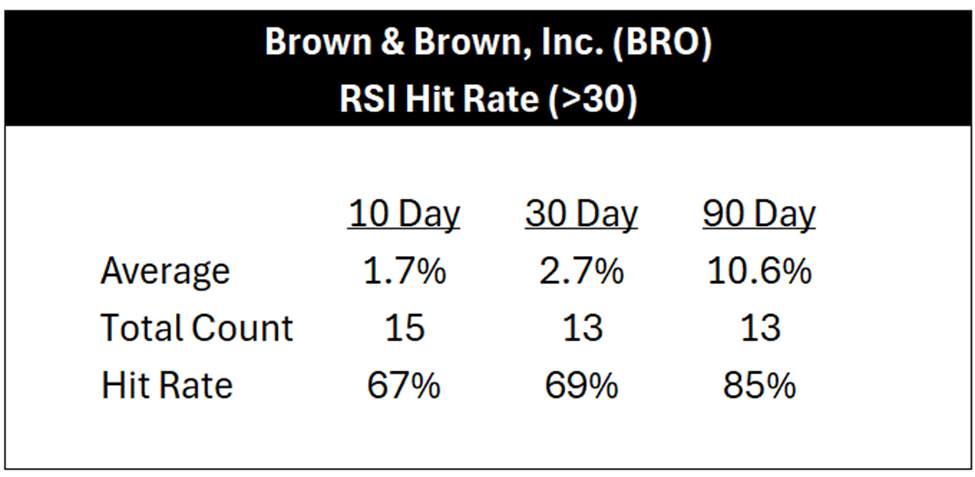

I then go back to see how the stock performed in the past when it triggered this RSI “buy” signal. Here is the data for BRO.

This is a tremendous track record!

Over the last 10 years, the stock has triggered this RSI “buy” signal 13 times, producing solid returns (averaging double digits) 85% of the time after 90 days.

These are the first six points in our system. As I mentioned earlier, BRO scored a perfect “15/15,” so it met all of the above criteria.

Now, let’s look at how the stock performed for our readers.

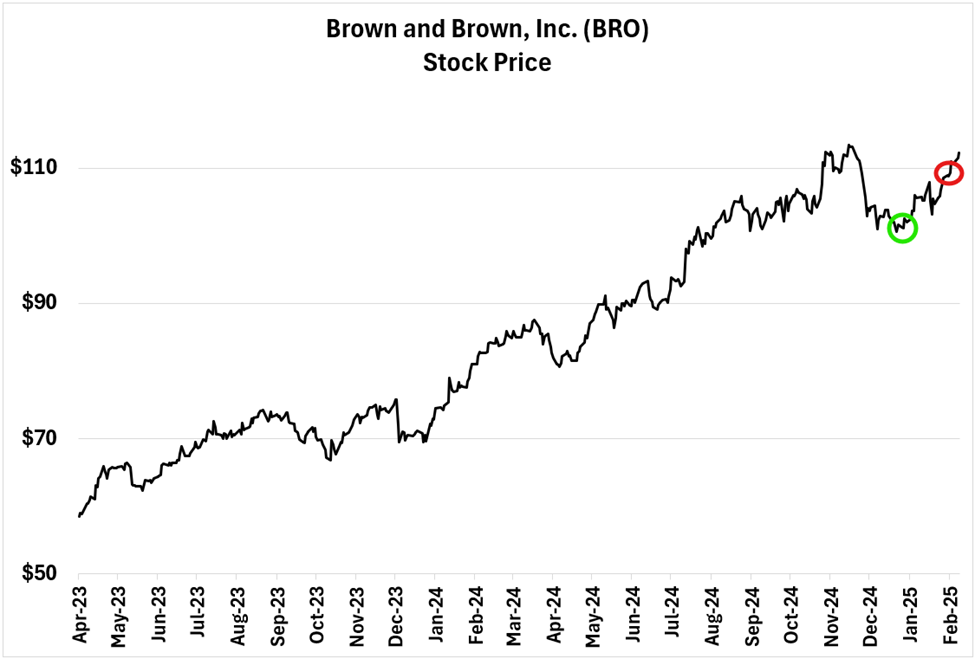

Here is the price chart with our “buy” and “sell” recommendations marked in green and red.

Readers who acted on our recommendation should have booked a profit of more than 8% in just 33 days.

That is a decent absolute return by itself. But when you consider the short time frame, it is a home run!

The strength of our technical indicators alone is enough to drive high-probability bets with solid returns.

Our real secret, though, is combining it with our analysis of the operations (or fundamentals) of the company.

I’ll have more to say on that in an upcoming issue of Truth & Trends. Stay tuned.

Sign Up Today for Free!

Truth & Trends brings you market insights and trading tips you won't find anywhere else — unless you have your own personal hedge fund manager on speed dial...

Meet Enrique Abeyta, one of Wall Street’s most successful hedge fund managers. With years of experience managing billions of dollars and navigating the highs and lows of the financial markets, Enrique delivers unparalleled market insights straight to your inbox.

In Truth & Trends, Enrique shares his personal take on what’s moving the markets, revealing strategies that made him a star in the world of high finance. Whether it’s uncovering the next big trend or breaking down the hottest stocks and sectors, Enrique’s insights are sharp, actionable, and proven to work in any market condition.

Inside these daily updates, you’ll gain:

- 50 years of combined trading wisdom distilled into actionable insights.

- A behind-the-scenes look at how Wall Street pros spot opportunities and avoid pitfalls.

- Exclusive strategies that Enrique personally uses to deliver exceptional returns — no fluff, just results.

To have Truth & Trends sent directly to your inbox every weekday, just enter your email address below to join this exclusive community of informed traders.

Don’t miss your chance to learn from one of the best in the business.

Sign up now and take your trading game to the next level.

“BTSD” — The Powell Probe Trade

Posted January 12, 2026

By Enrique Abeyta

Revealed: The New Momentum Trades for 2026

Posted January 09, 2026

By Greg Guenthner

5 Healthy Investing Habits to Start Today

Posted January 08, 2026

By Enrique Abeyta

2026: The Leaders, the Laggards, and a Wild Card

Posted January 05, 2026

By Enrique Abeyta

Optimism Wins: A Fresh Mindset for 2026

Posted January 01, 2026

By Enrique Abeyta